Online resources

You can find a lot of different online resources on opmas.dk covering Temporary Admission and full importation

On this page

Short & Sweet mails: Offering a quick insight into various topics about flying within the EU - NEW

FAQ: Frequently asked questions about TA

Reviews: Present an overview and a deeper insight in various subjects - NEW

Short articles and stories: Present short answers and deeper insights in various topics - NEW

Quick Guides: Cover Part 91 and 135 comparing full importation and TA - NEW

EU, UK and Schengen maps: 3 different maps made for customs and aviation use - NEW

Survey Results: Different surveys with in-depth analysis of specific topics

Glossary: Check the common words used in the aviation and customs world

On separate pages

Intro videos: Explainer videos on how to fly within the European Union

Flying to the UK: What is the situation in post-Brexit?

News: List of news flashes

Links: List of relevant links and other downloads

OPMAS Short & Sweet mails – offering a quick insight into various topics about flying within the EU

Short & Sweet No. 21

Part 4: Using Temporary Admission

– how to prepare for a customs ramp check

Added January 2024

We are seeing a trend where aircraft are checked for customs issues and operators are asked to prove TA compliance – quite commonly in Greece, France, Italy, Spain, and Portugal. Customs ramp checks only take two minutes if the operator is prepared but can take hours and sometimes days if the relevant paperwork is not ready at hand onboard the aircraft – also in all good scenarios where everything is correct.

Please click the various search bottoms to list the Short & Sweet mails by topic.

– how to prepare for a customs ramp check

Added Jan 2024 TA

Added Sep 2023 TA FI

Added Jan 2023 – Updated 2024 TA FI

Added Oct 2022 – Updated 2024 TA FI

– when does an operator need help?

Added Aug 2022 – Updated 2024 TA

Added June 2022 – Updated 2024 FI

Added May 2022 – Updated 2024 FI

– what do customs look for during a ramp check, and why?

Added May 2022 – Updated 2024 TA

Added Feb 2022 – Updated 2024 TA FI

– the Supporting Document

Added Dec 2021 – Updated 2024 TA

Added Oct 2021 – Updated 2024 TA FI

Added Sep 2021 – Updated 2024 TA

Added Mar 2021 – Updated 2024 FI

Added Mar 2021 – Updated 2024 FI

Added Feb 2021 – Updated 2024 TA FI

Added Nov 2020 – Updated 2024 TA FI

Frequently asked questions about Temporary Admission

Updated November 2023

The questions below represent the typical situations we are often asked to verify and advise whether an operator complies with the TA procedure when flying within the EU.

A quick overview

of aircraft importation

and admission issues

Updated April 2024

Our comments and interpretation of the judgment (C-33/11) from the European Court of Justice (ECJ) that allows international charter operators to be VAT-exempt (0%) during a full importation.

Our comments and interpretation of the judgment (C-33/11) from the European Court of Justice (ECJ) that allows international charter operators to be VAT-exempt (0%) during a full importation.OPMAS Short articles and stories – Present short answers and deeper insights in various topics

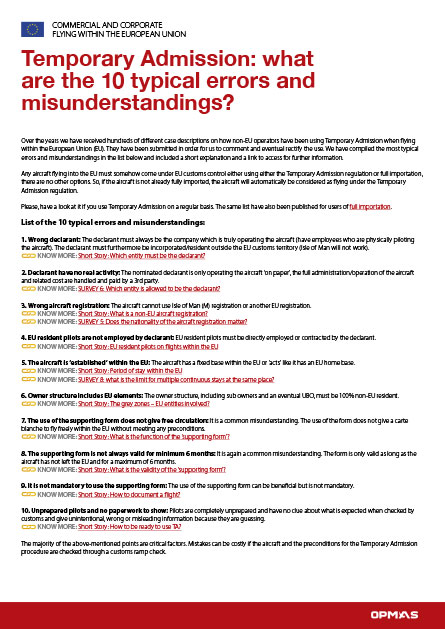

Full importation: what are the 10 typical errors and misunderstandings?

Full importation: what are the 10 typical errors and misunderstandings?

Updated November 2023

We have compiled the most typical errors and misunderstandings when using full importation.

The short story about Temporary Admission

The short story about Temporary Admission

Updated March 2024

Our short stories focus on important subjects, giving you a quick overview and deeper insight. Accordingly, specifications and conditions are not detailed. Temporary Admission is only for entities established outside the EU and has some limitations.

The short story about full importation

The short story about full importation

Updated March 2024

Our short stories focus on important subjects, giving you a quick overview and deeper insight. Accordingly, specifications and conditions are not detailed. Full importation is mainly for EU-established entities, grants free circulation for the aircraft, and offers a lot of privileges. Yet, it includes potential liabilities and procedures that must be handled correctly and continuously.

OPMAS Quick Guides – Compare Temporary Admission and full importation

Quick Guide for International Charter Operators

Quick Guide for International Charter Operators

– For AOC holders, Part 135 charter certificate holders, or similar

Updated March 2024

The Quick Guide covers the typical case where an aircraft is operated commercially by international charter operators.

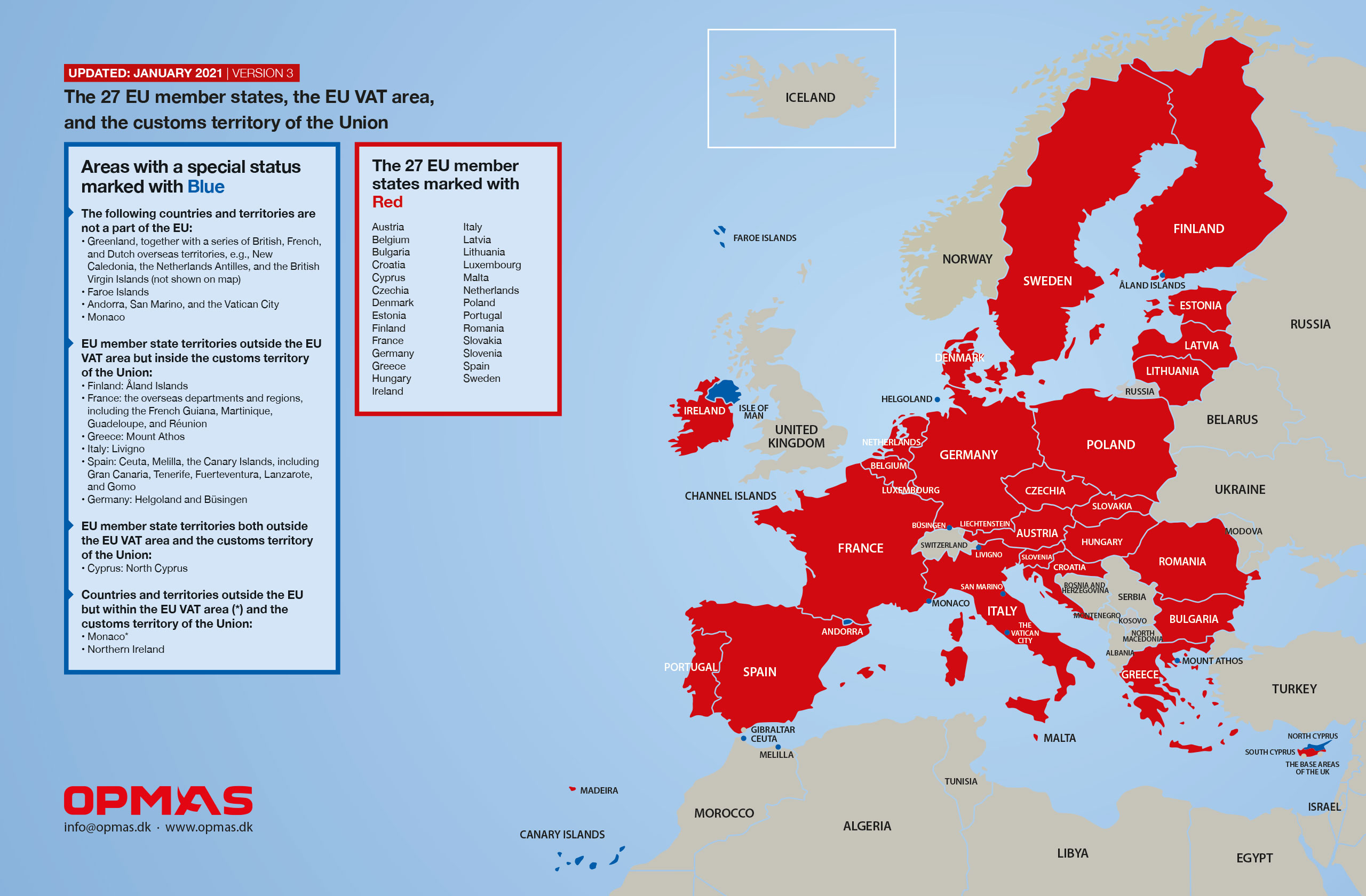

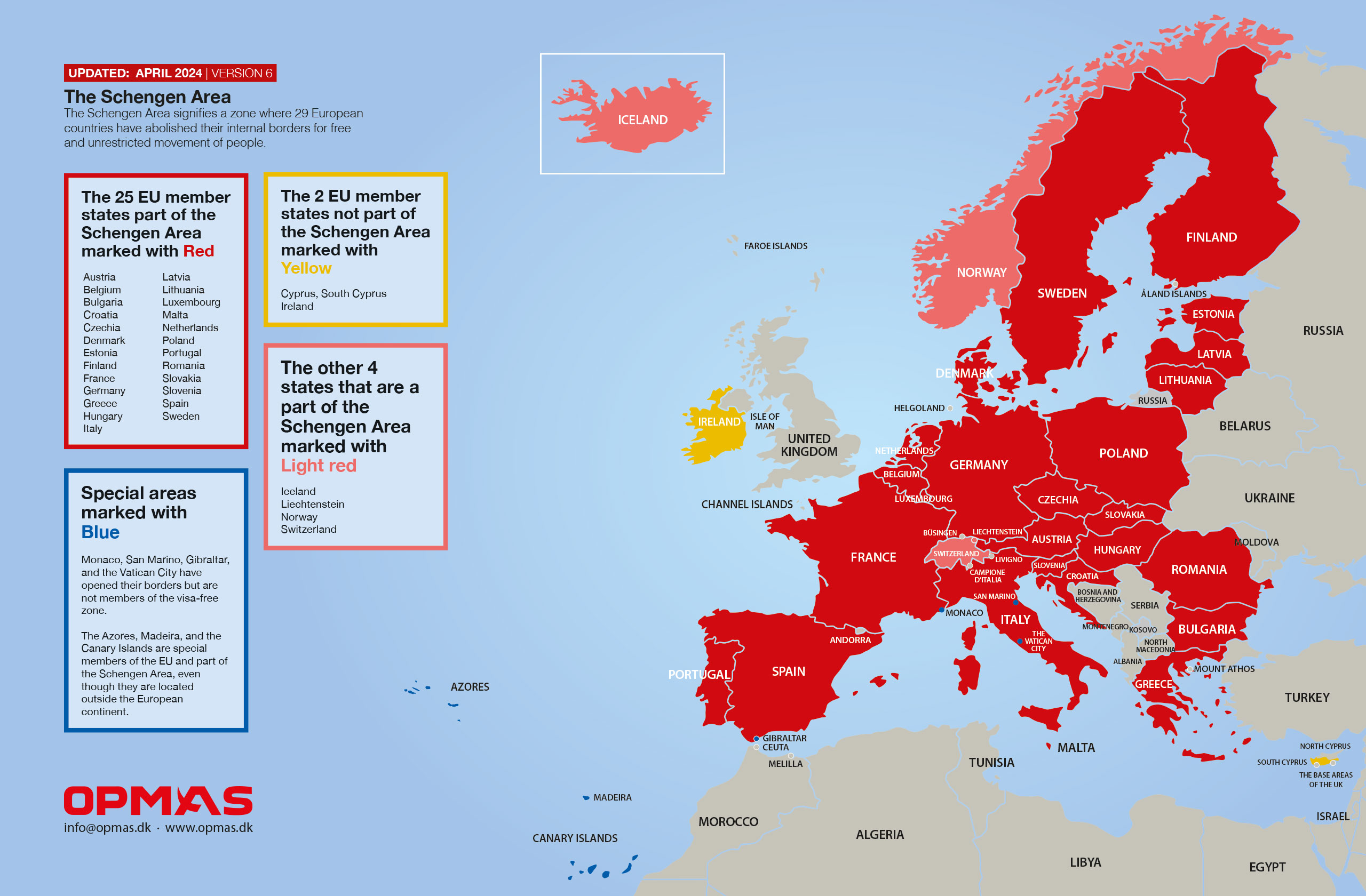

See the areas that are included and excluded in the VAT area and the customs territory of the Union. We have also added an updated Schengen map as people are often confused by the differences between the Schengen Area (passport zone) and the EU member states as well as the VAT area and the customs territory of the Union.

The 27 European Union member states and special member state territories

Updated January 2021

This map gives the full overview over the 27 EU member states, the VAT area and the customs territory.

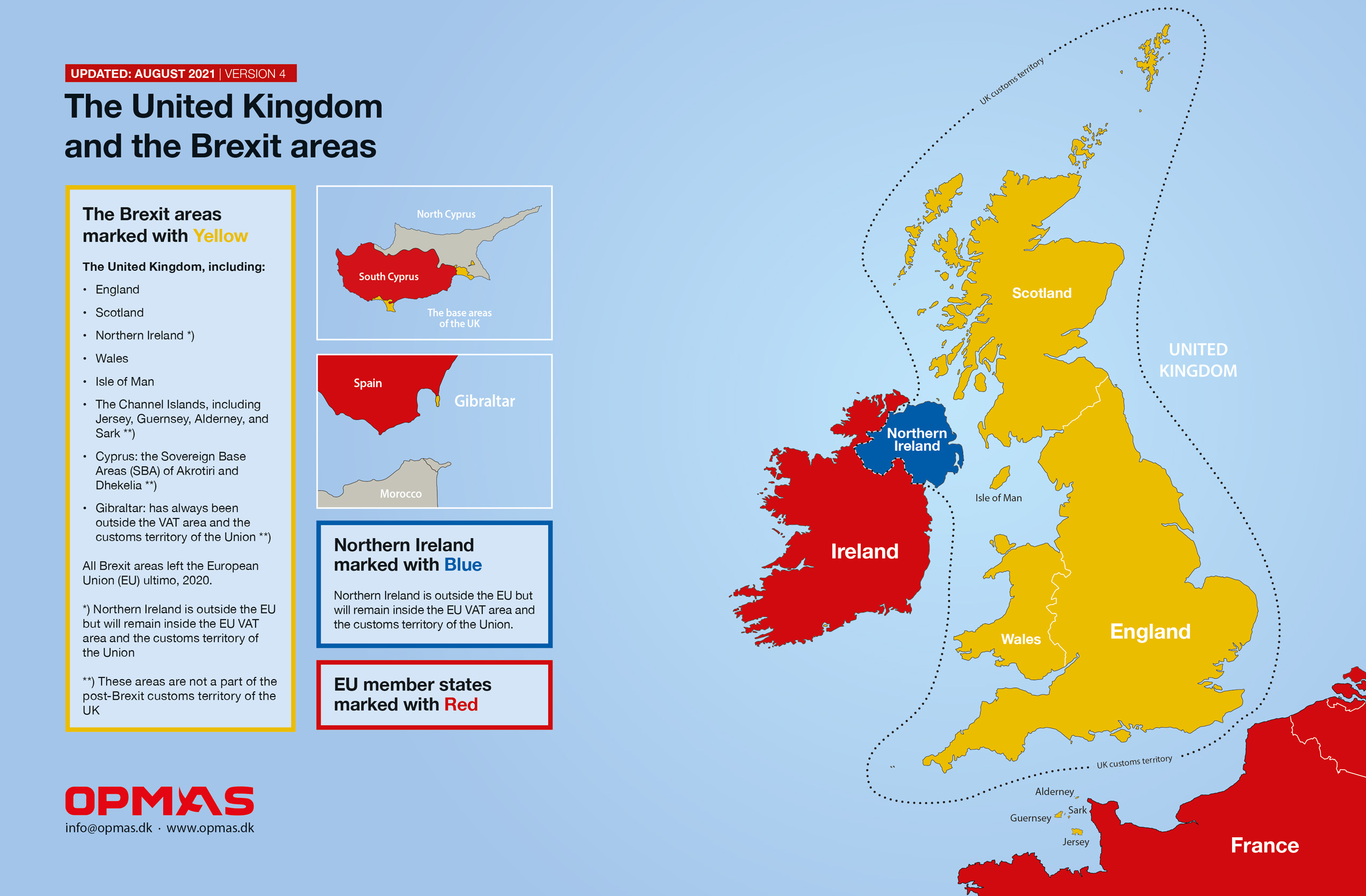

The United Kingdom and the Brexit areas

Updated August 2021

This map shows the United Kingdom and the Brexit areas in an enlarged view.

The Schengen passport area

Updated March 2024

This map gives a overview of the Schengen passport area.

Traditionally, there have been huge differences in local interpretations of various EU customs regulations. These differences often make it difficult for both EU and non-EU operators to determine right from wrong when flying in the EU as the local interpretations or approaches differ. We have therefore commissioned multiple verification surveys to create a snapshot of relevant importation/admission rules.

The surveys show that some EU member states and related territories have a somewhat lax practice of very low VAT/customs thresholds or missing implementation of the same, probably in order to attract business from the other EU member states. Operators should exercise caution and if in doubt always ask for a binding assessment ruling by the local authorities.

Index for surveys about full importation:

Survey 1: About private use, is non-business use accepted?

Survey 3: About private use, does the flight pattern/geography and size/type of compensation matter?

Index for surveys about Temporary Admission:

Survey 6: About the declarant

Survey 7: About the period of stay

Survey 8: About multiple stays

Survey 9: About the validity of the Supporting Document

Glossary

We have made a glossary of the most common words and terms used in the aviation world in connection with customs work and when flying within the European Union.

Online resources

You can find a lot of different online resources on opmas.dk covering Temporary Admission and full importation

On this page

Short & Sweet mails: Offering a quick insight into various topics about flying within the EU - NEW

FAQ: Frequently asked questions about TA

Reviews: Present an overview and a deeper insight in various subjects - NEW

Short articles and stories: Present short answers and deeper insights in various topics - NEW

Quick Guides: Cover Part 91 and 135 comparing full importation and TA - NEW

EU, UK and Schengen maps: 3 different maps made for customs and aviation use - NEW

Survey Results: Different surveys with in-depth analysis of specific topics

Glossary: Check the common words used in the aviation and customs world

On separate pages

Intro videos: Explainer videos on how to fly within the European Union

Flying to the UK: What is the situation in post-Brexit?

News: List of news flashes

Links: List of relevant links and other downloads

Read this review for a quick overview of the European Union VAT system.

Read this review for a quick overview of the European Union VAT system.