COMMERCIAL AND CORPORATE FLYING WITHIN THE EUROPEAN UNION

Short & Sweet no. 8

Do not fall into the operator trap when flying within the EU and UK

- What is the operator trap?

- Do not get things wrong from the get-go

- What are the pitfalls?

![]() Introduction

Introduction

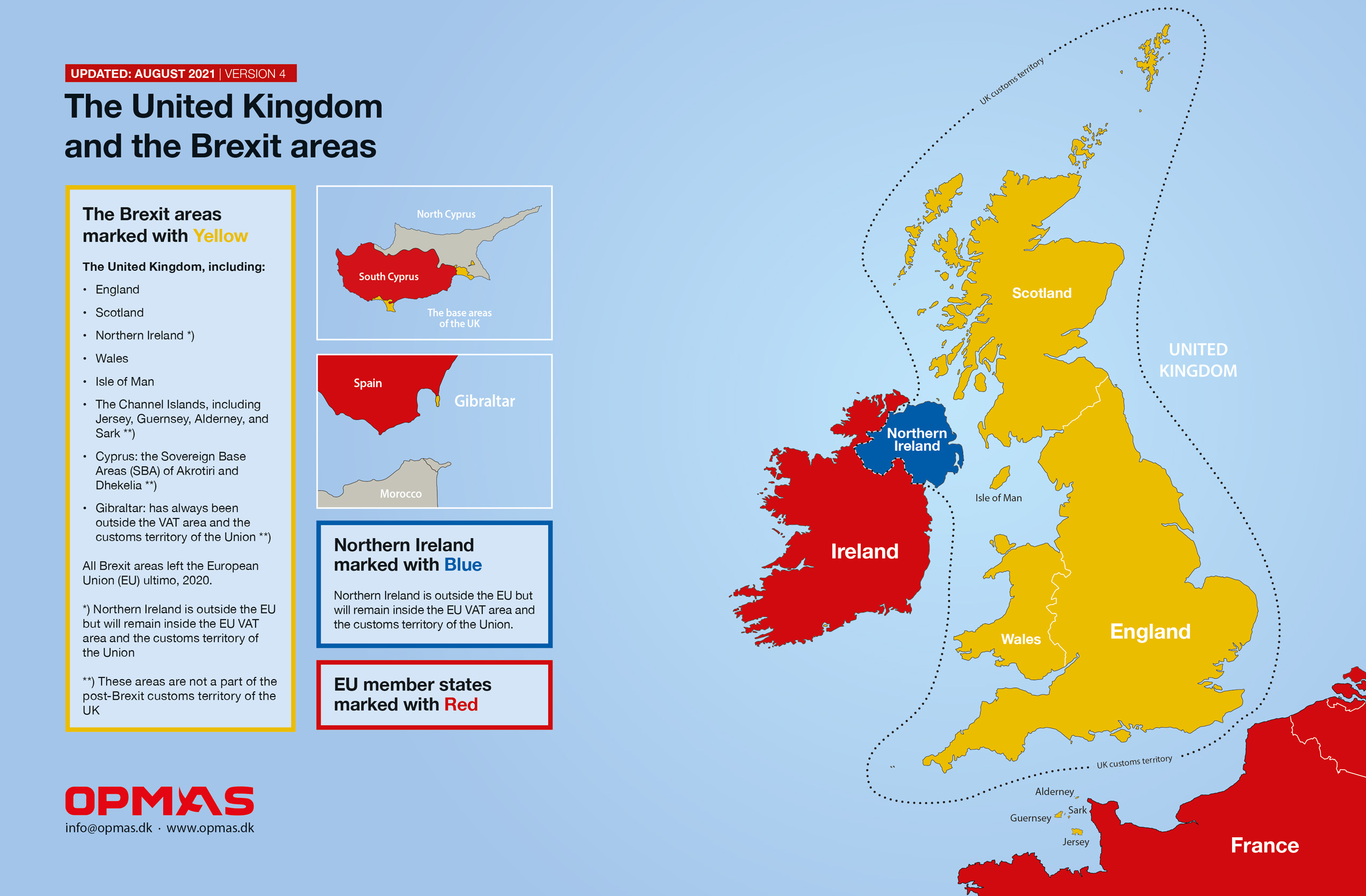

As we assume that most aircraft will eventually fly to the UK or that every owner at least wants the opportunity to fly freely within Europe and not just the EU, we have added the UK to this description.

We frequently receive the following inquiry: “We have just brought a new aircraft into our operation and will be flying to Europe. Please tell us how to do so properly”.

The statement above is frequently asked by professional managements and operating companies that have new clients as well as private and corporate operators where the aircraft ownership structure makes it difficult to operate the aircraft within Europe in accordance with the various customs regulations without vast consequences due to the aircraft ownership, management, and operating structure that does not fit into either of the two customs entry options, namely the Temporary Admission or full importation procedure.

We call the above situation the operator trap because reasonable solutions are sometimes simply not available. Our goal is to point out that the aircraft ownership, management, and operating structure are very important aspects to consider if an operator is planning to fly or eventually base an aircraft within the EU or the UK.

A quick background of the customs regulation

Any aircraft flying into the EU, or the UK will fly under customs control using either the Temporary Admission procedure or a full importation. There are no other options. The Temporary Admission procedure can only be used by EU or UK outsiders where the aircraft is owned (including any UBOs), operated, registered, and based outside the EU or the UK, leaving EU or UK insiders with only one option – full importation.

The pitfalls

Please be aware that the setups described below can create an operator trap. If an owner or operator can recognize their setup in one or more of the listed points below, the alarm bell should ring, and the owner or operator might consider re-structuring the setup before it is too late. Please remember that the list is not comprehensive and that the full importation and Temporary Admission procedures also have other preconditions and limitations that must be followed continuously.

Full importation:

Full importation:

- The owner or importing entity is a shell company

- The owner or importing entity is incorporated or domiciled in exotic places or jurisdictions known as tax havens

- The owner or importing entity is not using the aircraft 100% in their pursuit of real economic activity *)

- The aircraft is not commercially operated

- Some business activities, such as selected real estate activities, banking and finance, insurance, gaming, and holding companies, etc., are not subject to VAT meaning that an importing entity with such activities cannot deduct the imposed import VAT during a full importation even though the aircraft is used 100% for real business activities within the mentioned areas

Temporary Admission:

Temporary Admission:

- The owner entity is incorporated or domiciled within the EU

- Any potential lessee is incorporated or domiciled within the EU

- Any potential UBO or main user has habitual residence within the EU

- The physical operator is incorporated or domiciled within the EU

- The aircraft registration has origin within the EU *)

Temporary Admission:

Temporary Admission:

- The owner entity is incorporated or domiciled within the UK, including the Isle of Man *)

- Any potential lessee is incorporated or domiciled within UK, including the Isle of Man

- Any potential UBO or main user has habitual residence within the UK, including the Isle of Man

- The physical operator is incorporated or domiciled within the UK, including the Isle of Man

- The aircraft registration has origin within the UK, including the Isle of Man **)

The only option left

If the aircraft will operate within the EU, the only option left could be to pay the EU VAT, ranging from 15 to 27% of the aircraft’s value. This could also be the tragic result if customs find something wrong during a ramp check.

How can we help?

If you have questions about the above, please do not hesitate to contact us.

List of all OPMAS

Short & Sweet mails:

No. 24 – Can the Customs Warehouse procedure be used to close a deal?

Feb 2025 TA FI

No. 23 – Temporary Admission is supposed to be paperless, so why is documentation needed?

Oct 2024 TA

No. 22 – What does it take to be compliant?

Jun 2024 TA FI

No. 21 – Part 4: Using Temporary Admission – how to prepare for a customs ramp check

Jan 2024 – Updated 2025 TA

No. 20 – Buying or selling aircraft within, to, or from the EU

Nov 2023 TA FI

No. 19 – The real differences between full importation and Temporary Admission

Sep 2023 - Updated 2024 TA FI

No. 18 – Exporting an aircraft from the EU

Jun 2023 - Updated 2024 FI

No. 17 – What is the correct use of a corporate aircraft?

Mar 2023 - Updated 2024 FI

No. 16 – Which customs procedures can be used for parking an aircraft within the EU?

Jan 2023 - Updated 2024 TA FI

No. 15 – Liability and risk elements associated with EU importation and admission

Oct 2022 - Updated 2024 TA FI

No. 14 – Part 3: Using Temporary Admission – when does an operator need help?

Aug 2022 – Updated 2025 TA

No. 13 – Importation impacts when traveling the world in corporate aircraft

Jun 2022 - Updated 2024 FI

No. 12 – How to get the 0% airline VAT exemption meant for commercial operators

May 2022 - Updated 2024 FI

No. 11 – Part 2: Using Temporary Admission – what do customs look for during a ramp check, and why?

Mar 2022 – Updated 2025 TA

No. 10 – How to handle aircraft maintenance correct in a customs context

Feb 2022 - Updated 2024 TA FI

No. 9 – Part 1: Using Temporary Admission – the Supporting Document

Dec 2021 – Updated 2025 TA

No. 8 – Do not fall into the operator trap when flying within the EU and UK

Oct 2021 - Updated 2024 TA FI

No. 7 – Which offshore aircraft registrations can be used with Temporary Admissions when flying within the EU and UK?

Sep 2021 - Updated 2024 TA

No. 6 – Flying with EU-resident persons onboard when using Temporary Admission

Aug 2021 - Updated 2025 TA

No. 5 – What about private use of corporate aircraft?

May 2021 - Updated 2025 TA FI

No. 4 – What does ‘VAT paid’ mean?

Mar 2021 - Updated 2024 FI

No. 3 – Is a full importation needed in both the UK and the EU27?

Mar 2021 - Updated 2024 FI

No. 2 – Flying commercially within the EU

Feb 2021 - Updated 2025 TA FI

No. 1 – Flying with the CEO

Nov 2020 - Updated 2025 TA FI