COMMERCIAL AND CORPORATE FLYING WITHIN THE EUROPEAN UNION

Short & Sweet no. 21

Part 4: Using Temporary Admission

– how to prepare for a customs ramp check

Added 2024 – Updated March 2024

- How to be prepared to handle a customs ramp check?

- Why is documentation needed when TA is supposed to be a paperless procedure?

- What do customs want to know?

We are seeing a trend where aircraft are checked for customs issues and operators are asked to prove TA compliance – quite commonly in Greece, France, Italy, Spain, and Portugal. Customs ramp checks only take two minutes if the operator is prepared but can take hours and sometimes days if the relevant paperwork is not ready at hand onboard the aircraft – also in all good scenarios where everything is correct.

Let us dig deeper into the topic and examine what kind of underlying documentation and information an operator should prepare and have available when encountering EU customs during customs ramp checks.

| Short & Sweet mail no. 6 | Flying with EU-resident persons onboard when using TA |

| Short & Sweet mail no. 9 | Part 1: What is the Supporting Document, and how do you use it? |

| Short & Sweet mail no. 11 | Part 2: What do customs look for during a ramp check, and why? |

| Short & Sweet mail no. 14 | Part 3: In which scenarios will an operator need help or guidance? |

The customs aspect of flying within the EU

Any aircraft flying into the EU will operate under customs control using either the Temporary Admission procedure (TA) or full importation. There are no other options. If the aircraft is not already fully imported, the aircraft will automatically be considered as flying under the TA procedure even though the owner or operator has not themselves taken any action to activate this procedure or realized that their aircraft is flying under TA. The TA procedure is thus always required when flying to the EU, even for a flight with only one stop within the EU. Here, non-compliance with TA will most likely activate a direct payment of the VAT (ranging from 17-27%) and customs duty (2.7%) for the owner or operator. The TA procedure can only be used by EU outsiders where the aircraft is owned (including any UBOs), operated, registered, and based outside the EU, leaving EU insiders only one option: full importation. EU outsiders can, of course, choose to use full importation instead of TA if they find it beneficial. However, both options can be used commercially or privately if applied correctly.

How does Temporary Admission work?

The use of TA is designed to be a paperless process with a voluntary option to document entries and exits using a Supporting Document, meaning that a qualifying aircraft can enter the EU without any customs contact or paper declarations. It is the EU Commission’s opinion that the bare act of crossing the outer EU border counts as a customs declaration. Help with documenting or clarifying TA compliance might not be needed if the aircraft only has flights that start or end outside the EU (no internal EU trips), does not carry any EU-resident crew or passengers, and the crew and operator understand the practical usage of the TA procedure as these types of flights typically do not trigger customs ramp checks. However, we will always recommend that operators check and document full TA compliance before flying to the EU, as other factors than those mentioned might also influence compliance.

Temporary Admission is supposed to be paperless, so why is documentation needed?

Unfortunately, the paperless entry and exit procedure has created a common misunderstanding that an operator is not required to present relevant documentation to prove TA compliance upon request from customs. Only the entry and exit are supposed to be paperless, but the operator must continuously live up to the preconditions of TA, handle the limitations correctly, and be able to document these at any time, even if flights are just in and out of the EU with only one visited destination. Correct documentation proving TA compliance is a make-or-break issue during customs ramp checks, and the so-called Supporting Document (if used upon entry) does not prove TA compliance alone. To learn more, please view our new explainer video about the topic.

Temporary Admission is not without preconditions and consequences

When flying to the EU under TA, the aircraft must adhere to certain preconditions and be granted a suspension of all normal EU taxes and duties. As a consequence, there will naturally be customs checks, ensuring that the TA terms are correctly fulfilled and documented. Failure to adhere to or document the terms properly most often results in consequences. Here, the lack of relevant documentation has stopped or grounded several aircraft over the years.

What do customs want to know?

It is important to immediately give local customs total comfort and demonstrate that the operator is on top of the situation and understands TA. The pilots must be able to explain and document why the aircraft is eligible to use the TA procedure. Please be aware that the Supporting Document does not function like this.

- Customs procedure used for the trip

- Description of the full aircraft owner and operator structure

- Reasons why the above structure is TA-compliant

- Reasons why the limitations are correctly handled

- Period of stay

- EU destinations

- Purpose of flight for passengers

- Naming the correct operator in customs (TA) terms

- Type of operation in customs (TA) terms

Be prepared to meet the EU customs

No operator should fly to the EU unprepared and unable to explain and document which customs procedure they are using. Being ready for customs ramp checks should be seen parallel to how an operator prepares for an eventual SAFA ramp check. We experience that many pilots are not trained and prepared to handle the above issues convincingly and thus fly without a ready-to-use portfolio to support the use of TA.

IMPORTANT!

How to handle a customs ramp check

Ramp checks will eventually happen, so any operator ought to be prepared to avoid wasting time on the ramp. All experience shows that a convincing portfolio and well-prepared pilots will close all inspection issues effectively, while a fumbling start will often prolong an inspection for hours or days. About one-third of all recorded TA problems are related to the operators’ inability to understand and document the correct use of TA. In these cases, compliance is not an issue, only the lack of ability to prove compliance.

Correct documentation is a make-or-break issue

Operators should always consider how to document TA compliance as well as handle and secure the known grey zone areas when using TA. The relevant documentation can be conditioned without help from OPMAS, but we will be happy to help and have years of experience with this process. We offer different TA solutions depending on the risk profile and typical flight pattern. Please inquire for more details.

The Temporary Admission procedure has become a very well-defined customs procedure

Please note that TA can be used to fly privately, corporately, and commercially within the EU without any problems and with EU-resident persons onboard if applied correctly. Since 2014, the TA procedure has become a very well-defined customs procedure, especially for corporate and commercial aviation. This is thanks to the huge effort from, e.g., the EU Commission and NBAA.

Legal background for Temporary Admission

The Istanbul convention from 1990, regulating the worldwide usage of TA, is not very precise, and the EU Commission has been and is continuously publishing various working papers and guidelines to clarify the correct understanding of TA and its usage in the EU. The 2014 working paper from the Union Customs Code Committee (available in English, French, and German) is especially important. Operators should always be aware that these documents are not binding for EU member states, which is why different interpretations exist between member states, thus also why it is important to have a competent customs agency outlining the correct use and understanding based on the specific setup. The problem with local interpretations is often related to flights within France, Spain, Portugal, Italy, and Greece.

Click here to see a list of the known grey zone areas where different interpretations of the TA procedure exist and where operators often need guidance to use TA safely. None of the grey zone areas create problems against using TA if correctly handled and documented.

How can we help?

If you have questions about the above, please do not hesitate to contact us.

List of all OPMAS

Short & Sweet mails:

No. 23 – Temporary Admission is supposed to be paperless, so why is documentation needed?

Oct 2024 TA

No. 22 – What does it take to be compliant?

Jun 2024 TA FI

No. 21 – Part 4: Using Temporary Admission – how to prepare for a customs ramp check

Jan 2024 TA

No. 20 – Buying or selling aircraft within, to, or from the EU

Nov 2023 TA FI

No. 19 – The real differences between full importation and Temporary Admission

Sep 2023 - Updated 2024 TA FI

No. 18 – Exporting an aircraft from the EU

Jun 2023 - Updated 2024 FI

No. 17 – What is the correct use of a corporate aircraft?

Mar 2023 - Updated 2024 FI

No. 16 – Which customs procedures can be used for parking an aircraft within the EU?

Jan 2023 - Updated 2024 TA FI

No. 15 – Liability and risk elements associated with EU importation and admission

Oct 2022 - Updated 2024 TA FI

No. 14 – Part 3: Using Temporary Admission – when does an operator need help?

Aug 2022 – Updated 2024 TA

No. 13 – Importation impacts when traveling the world in corporate aircraft

Jun 2022 - Updated 2024 FI

No. 12 – How to get the 0% airline VAT exemption meant for commercial operators

May 2022 - Updated 2024 FI

No. 11 – Part 2: Using Temporary Admission

– what do customs look for during a ramp check, and why?

Mar 2022 – Updated 2024 TA

No. 10 – How to handle aircraft maintenance correct in a customs context

Feb 2022 - Updated 2024 TA FI

No. 9 – Part 1: Using Temporary Admission – the Supporting Document

Dec 2021 – Updated 2024 TA

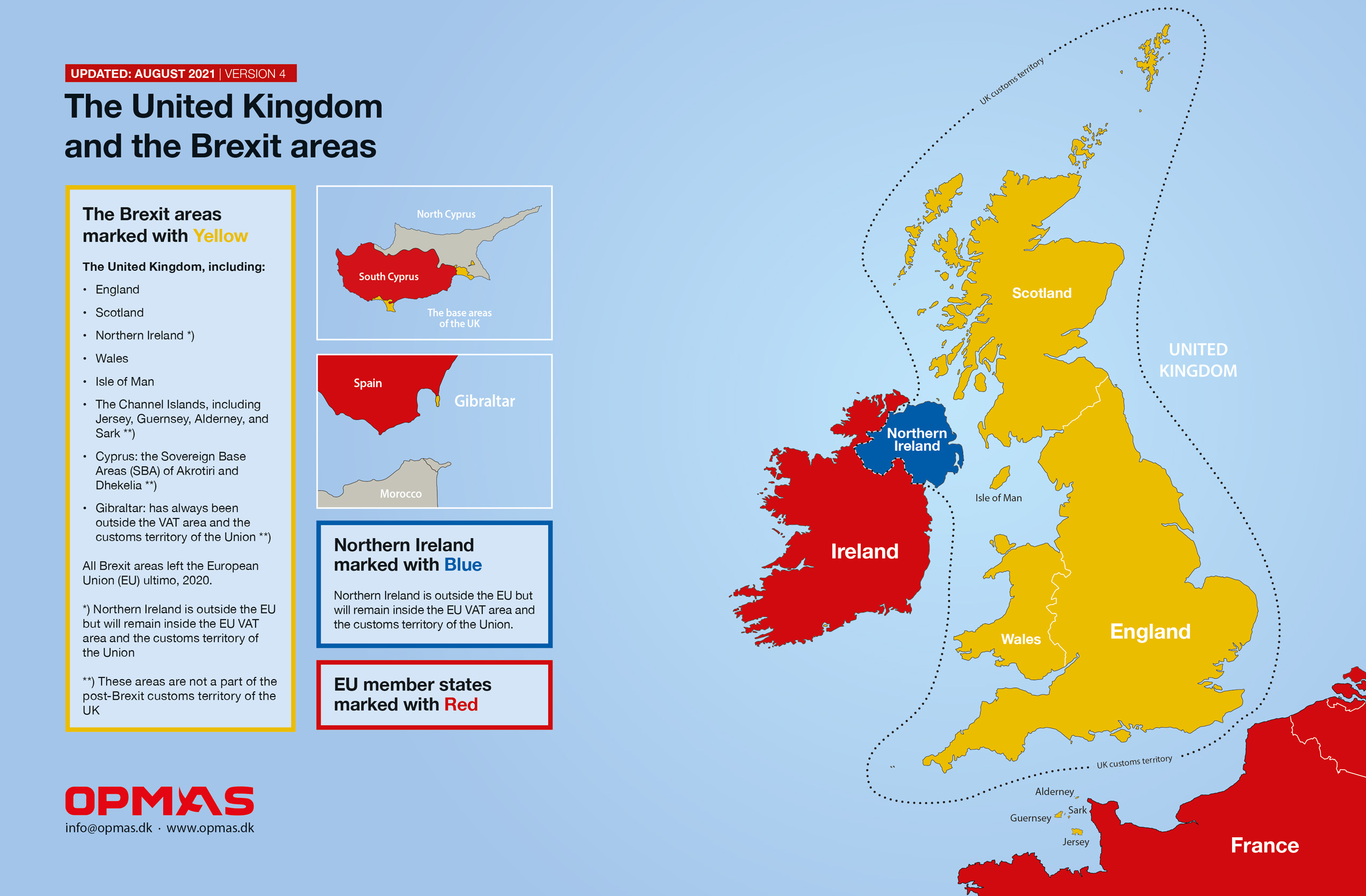

No. 8 – Do not fall into the operator trap when flying within the EU and UK

Oct 2021 - Updated 2024 TA FI

No. 7 – Which offshore aircraft registrations can be used with Temporary Admissions when flying within the EU and UK?

Sep 2021 - Updated 2024 TA

No. 6 – Flying with EU-resident persons onboard when using Temporary Admission

Aug 2021 - Updated 2024 TA

No. 5 – What about private use

of corporate aircraft?

May 2021 - Updated 2024 TA FI

No. 4 – What does ‘VAT paid’ mean?

Mar 2021 - Updated 2024 FI

No. 3 – Is a full importation needed

in both the UK and the EU27?

Mar 2021 - Updated 2024 FI

No. 2 – Flying commercially

within the EU

Feb 2021 - Updated 2024 TA FI

No. 1 – Flying with the

CEO

Nov 2020 - Updated 2024 TA FI