COMMERCIAL AND CORPORATE FLYING WITHIN THE EUROPEAN UNION

Short & Sweet no. 11

Part 2: Using Temporary Admission

– what do customs look for during a ramp check, and why?

Added 2022 – Updated March 2024

- What do customs look for during a ramp check, and why?

- Why are corporate or commercial operators often checked?

- Why are airlines rarely ramp checked by customs?

What are customs looking for when aircraft are arriving in the EU? Let us dive right into it.

Other Short & Sweet articles about arriving in the EU using the TA procedure.

| Short & Sweet mail no. 6 | Flying with EU-resident persons onboard when using TA |

| Short & Sweet mail no. 9 | Part 1: What is the Supporting Document, and how do you use it? |

| Short & Sweet mail no. 14 | Part 3: In which scenarios will an operator need help or guidance? |

| Short & Sweet mail no. 21 | Part 4: How do you prepare to handle a customs ramp check? |

The customs aspect of flying within the EU

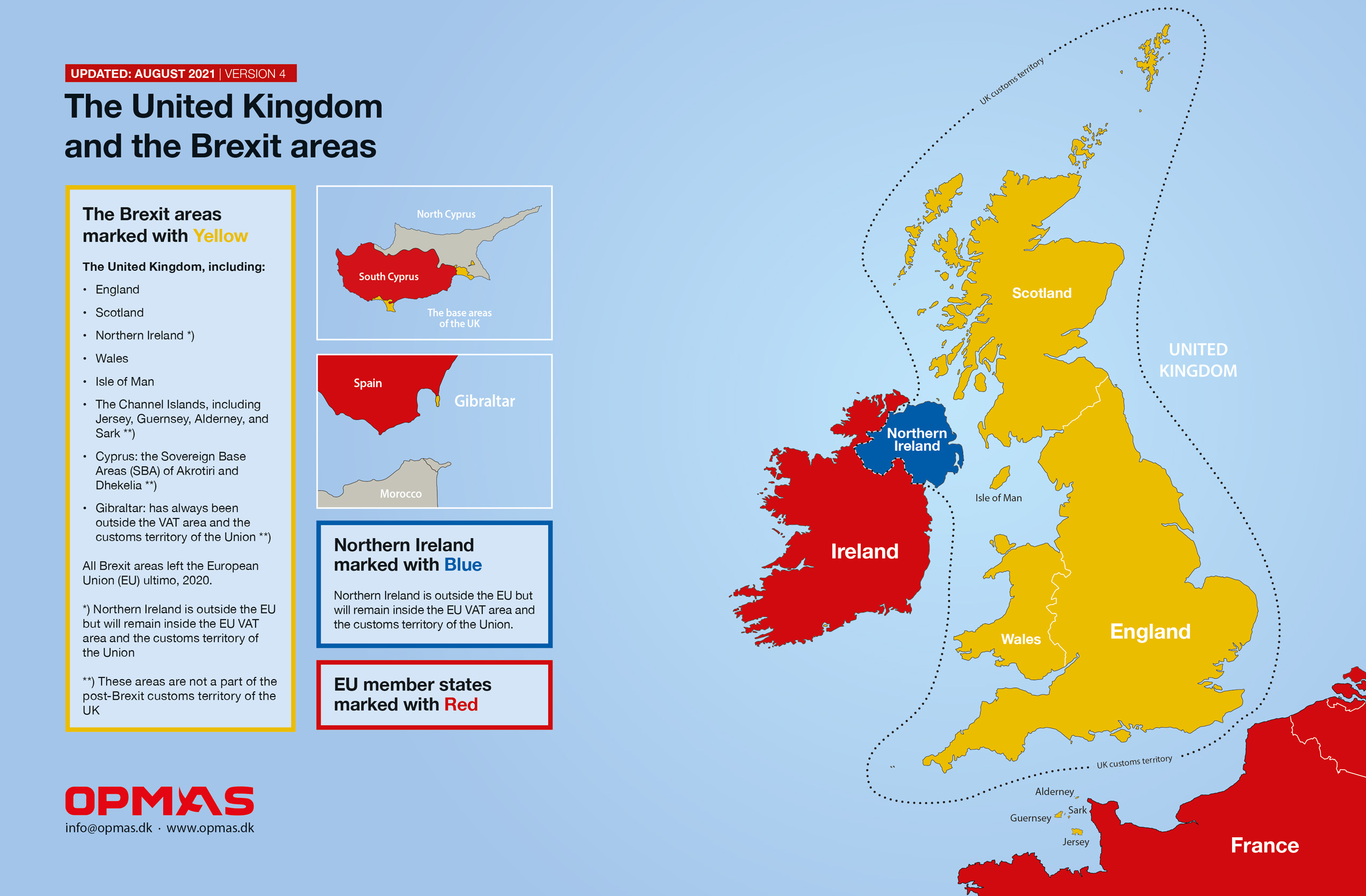

Any aircraft flying into the EU will operate under customs control using either the Temporary Admission procedure (TA) or full importation. There are no other options. If the aircraft is not already fully imported, the aircraft will automatically be considered as flying under the TA procedure even though the owner or operator has not themselves taken any action to activate this procedure or realized that their aircraft is flying under TA. The TA procedure is thus always required when flying to the EU, even for a flight with only one stop within the EU. Here, non-compliance with TA will most likely activate a direct payment of the VAT (ranging from 17-27%) and customs duty (2.7%) for the owner or operator. The TA procedure can only be used by EU outsiders where the aircraft is owned (including any UBOs), operated, registered, and based outside the EU, leaving EU insiders only one option: full importation. EU outsiders can, of course, choose to use full importation instead of TA if they find it beneficial. However, both options can be used commercially or privately if applied correctly.

What do customs look for?

Customs are overall looking to check the compliance in scenarios, such as:

- They look to check the aircraft operation for TA compliance

- They also look for EU insiders with an outdated or void importation

- They are even looking for EU insiders without a full importation where operators are claiming to fly legally under TA

There are many myths about the (wrong) use of TA, such as the scenarios below, both of which will have the full attention of customs during a compliance check:

- Some seem to think that they can use TA for the first 180 days within the EU before fully importing the aircraft

- Some operators think that Cyprus ownership is fine with TA

Why are corporate or commercial operators often checked?

Non-EU corporate or commercial operators are often ramp checked. Their aircraft are not easy to recognize, and customs do not know their background or intentions. Non-EU commercial operators can fly anywhere within the EU under TA as long as they have or are able to obtain proper traffic rights. Most non-EU corporate operators flying under TA will have the same flying privileges as under full importation but with more flexibility and extra advantages, such as unrestricted flying with personal family and EU-resident guests without any consequences, and holds no tax, VAT, or duty liability anywhere within the EU, etc. Thus, non-EU operators are regularly checked by EU customs, ensuring that they follow the TA procedure strictly so that the advantageous TA privileges are not abused.

Why are airlines rarely ramp checked?

We are often asked something along the lines:“I wonder if all non-EU carriers like Emirates or American carriers deal with the Temporary Admission when arriving within the EU”. These airlines are indeed flying under TA, and it is a common misunderstanding that TA and commercial traffic cannot be combined. Yet, why are these airlines rarely ramp checked – if ever? The obvious answer is that customs know they are well-established non-EU companies with traffic rights, so there is no reason to check them.

Correct documentation is a make-or-break issue

Even though using TA is supposed to be a simple, paperless process for most operators, documentation must not be disregarded. Correct documentation proving TA compliance is a make-or-break issue during customs ramp checks. The Supporting Document (if used upon entry) alone does not prove TA compliance. Only the entry and exit are supposed to be paperless, but the operator must continuously live up to the TA preconditions, handle the limitations correctly, and be able to document these at any time, even if flights are just in and out of the EU with only one visited destination. Also, operators should always consider how to document TA compliance as well as handle and secure the known grey zone areas when using TA. The relevant documentation can be conditioned without help from OPMAS, but we will be happy to help and have years of experience with this process. We offer different TA solutions depending on the risk profile and typical flight pattern. Please inquire for more details.

The Temporary Admission procedure has become a very well-defined customs procedure

Please note that TA can be used to fly privately, corporately, and commercially within the EU without any problems and with EU-resident persons onboard if applied correctly. Since 2014, the TA procedure has become a very well-defined customs procedure, especially for corporate and commercial aviation. This is thanks to the huge effort from, e.g., the EU Commission and NBAA.

Legal background for Temporary Admission

The Istanbul convention from 1990, regulating the worldwide usage of TA, is not very precise, and the EU Commission has been and is continuously publishing various working papers and guidelines to clarify the correct understanding of TA and its usage in the EU. The 2014 working paper from the Union Customs Code Committee (available in English, French, and German) is especially important. Operators should always be aware that these documents are not binding for EU member states, which is why different interpretations exist between member states, thus also why it is important to have a competent customs agency outlining the correct use and understanding based on the specific setup. The problem with local interpretations is often related to flights within France, Spain, Portugal, Italy, and Greece.

Click here to see a list of the known grey zone areas where different interpretations of the TA procedure exist and where operators often need guidance to use TA safely. None of the grey zone areas create problems against using TA if correctly handled and documented.

How can we help?

If you have questions about the above, please do not hesitate to contact us.

List of all OPMAS

Short & Sweet mails:

No. 22 – What does it take to be compliant?

Jun 2024 TA FI

No. 21 – Part 4: Using Temporary Admission – how to prepare for a customs ramp check

Jan 2024 TA

No. 20 – Buying or selling aircraft within, to, or from the EU

Nov 2023 TA FI

No. 19 – The real differences between full importation and Temporary Admission

Sep 2023 - Updated 2024 TA FI

No. 18 – Exporting an aircraft from the EU

Jun 2023 - Updated 2024 FI

No. 17 – What is the correct use of a corporate aircraft?

Mar 2023 - Updated 2024 FI

No. 16 – Which customs procedures can be used for parking an aircraft within the EU?

Jan 2023 - Updated 2024 TA FI

No. 15 – Liability and risk elements associated with EU importation and admission

Oct 2022 - Updated 2024 TA FI

No. 14 – Part 3: Using Temporary Admission – when does an operator need help?

Aug 2022 – Updated 2024 TA

No. 13 – Importation impacts when traveling the world in corporate aircraft

Jun 2022 - Updated 2024 FI

No. 12 – How to get the 0% airline VAT exemption meant for commercial operators

May 2022 - Updated 2024 FI

No. 11 – Part 2: Using Temporary Admission

– what do customs look for during a ramp check, and why?

Mar 2022 – Updated 2024 TA

No. 10 – How to handle aircraft maintenance correct in a customs context

Feb 2022 - Updated 2024 TA FI

No. 9 – Part 1: Using Temporary Admission – the Supporting Document

Dec 2021 – Updated 2024 TA

No. 8 – Do not fall into the operator trap when flying within the EU and UK

Oct 2021 - Updated 2024 TA FI

No. 7 – Which offshore aircraft registrations can be used with Temporary Admissions when flying within the EU and UK?

Sep 2021 - Updated 2024 TA

No. 6 – Flying with EU-resident persons onboard when using Temporary Admission

Aug 2021 - Updated 2024 TA

No. 5 – What about private use

of corporate aircraft?

May 2021 - Updated 2024 TA FI

No. 4 – What does ‘VAT paid’ mean?

Mar 2021 - Updated 2024 FI

No. 3 – Is a full importation needed

in both the UK and the EU27?

Mar 2021 - Updated 2024 FI

No. 2 – Flying commercially

within the EU

Feb 2021 - Updated 2024 TA FI

No. 1 – Flying with the

CEO

Nov 2020 - Updated 2024 TA FI