COMMERCIAL AND CORPORATE FLYING WITHIN THE EUROPEAN UNION

Short & Sweet no. 20

Buying or selling aircraft within, to, or from the EU

![]()

- What is the EU customs angle?

- Where to close an aircraft sale

- Do not fall into the PPI trap

- Demonstration of aircraft

We are often asked how to choose the correct EU customs procedure when selling an aircraft. We are often asked where to perform the Pre-Purchase Inspection (PPI), where to deliver the aircraft, and if the seller or buyer is EU-based. In this article, we dive a bit deeper into the topic and examine how the different customs procedures can be used in this respect.

We have set up four typical scenarios. Please have a look.

A: If both seller and buyer are EU-based

PPI: This can happen anywhere.

Place of delivery and closing: This can happen anywhere.

VAT issues: Typically use reverse charge with the EU VAT numbers for both seller and buyer.

Customs issues: None if the aircraft is delivered inside the EU.

B: If only seller is EU-based

PPI: This can happen anywhere.

Place of delivery and closing: This can happen anywhere, but seller’s EU home state is often the most uncomplicated jurisdiction and should be the primary choice. Seller can easily export the aircraft out of the EU, which can be difficult to perform outside seller’s own member state.

VAT issues: Seller can sell without any EU VAT if the aircraft departs the EU on the first flight.

Customs issues: None if the aircraft is sold for export.

C: If only buyer is EU-based

PPI: This can happen anywhere, but please see the comment below about having an EU-based PPI.

Place of delivery and closing: This can happen anywhere, but non-EU seller’s home state is often the most uncomplicated jurisdiction and should be the primary choice. Seller can export the aircraft without complications.

VAT issues: Seller can sell without any local or EU VAT.

Customs issues: None, as the aircraft is delivered outside the EU. The EU buyer must, of course, import the aircraft at the first port of entry within the EU. This destination should also be the EU home state of the buyer in order not to jeopardize the normal VAT importation procedures on handling VAT via an exemption or by deducting the VAT.

D: If either seller or buyer are EU-based

Stay out of the EU. There is no reason to complicate the process by adding extra jurisdictions.

The PPI process

Let us illustrate this situation with a case where we have a non-EU seller and an EU buyer with the PPI inside the EU, yet not in the EU buyer’s home state. A workshop often requires an Inward Processing (IP) customs procedure initiated in order to be VAT neutral and customs compliant. The correct use of the IP procedure for a PPI is often questionable, as a PPI does not qualify as “work on the aircraft”. Here, we are instead talking about a sales inspection. Secondly, an aircraft under IP cannot be sold before the aircraft is discharged from the IP. This can only happen if the aircraft departs the EU before the closing, which, in a customs context, makes it impossible to close correctly at the place of the PPI. The PPI workshop can choose not to use the IP procedure for the PPI and ask the non-seller to pay the full fee for the PPI, including local EU VAT. Yet, be aware that some EU member states see the IP procedure as mandatory for all non-EU aircraft in their hangar. Also, the EU Commission has in their guidelines stipulated that neither a full importation nor a Temporary Admission (TA) can be used for any kind of (maintenance) work in cases like this. Thus, delicate dilemmas and grey zone areas exist.

Do not fall into the PPI trap

Another problem occurs if the seller and buyer want to close while the aircraft is still at the PPI place within the EU. If the deal is closed outside the buyer’s EU home state, the closing jurisdiction will have the right to collect VAT and can render a later importation void at the buyer’s EU home state. While it is an extra cost, this can be solved by departing the place of the PPI for a non-EU destination after the closing before flying to the EU home state of the buyer. Moreover, the seller might face several time-consuming obstacles and high costs in the process of performing the often-required EU exportation of the aircraft. This is because the seller has no residence in the EU member state where the PPI occurred. While seller or buyer could consider registering for EU VAT and importation at the closing jurisdiction, there are many time-consuming problems, extra costs, and liabilities to consider. Nobody should want this if simple planning could eliminate it.

We call this situation the PPI trap.

Conclusion

1) Always choose the PPI location where the deal can be closed without problems.

2) The workshop should always ask the local EU customs which customs procedure to use for a PPI. Over the years, we have noticed many ways of handling a PPI. Therefore, we recommend asking the local customs for advice in writing. It is essential that customs have 100% understood what a PPI process involves.

Other pitfalls when buying and selling aircraft

Basel airport: Basel is a multination airport, so be aware if a PPI and a later closing occur at Basel airport, as this can trigger problems if done incorrectly. It is essential that the aircraft arrives and departs using the correct ICAO designator and that the PPI and later closing take place at the correct customs zone. Also, operators must be informed that it is not possible to depart using the Swiss ICAO designator.

Demonstration of aircraft for sale: A non-EU seller, especially manufacturers, often fly to the EU to showcase and demonstrate an aircraft for sale using TA. In the EU customs code, it is not carved in stone that such a purpose is correct use of TA, even if no fee is charged for the demonstration flights. Any use of TA while demonstrating aircraft should be secured in all cases.

How can we help?

Please do not hesitate to contact us regarding your specific situation. We will advise you of the best solution for your situation and needs. We counsel these types of cases dozens of times every year. For more information, go to: www.opmas.dk/contact

List of all OPMAS

Short & Sweet mails:

No. 24 – Can the Customs Warehouse procedure be used to close a deal?

Feb 2025 TA FI

No. 23 – Temporary Admission is supposed to be paperless, so why is documentation needed?

Oct 2024 TA

No. 22 – What does it take to be compliant?

Jun 2024 TA FI

No. 21 – Part 4: Using Temporary Admission – how to prepare for a customs ramp check

Jan 2024 – Updated 2025 TA

No. 20 – Buying or selling aircraft within, to, or from the EU

Nov 2023 TA FI

No. 19 – The real differences between full importation and Temporary Admission

Sep 2023 - Updated 2024 TA FI

No. 18 – Exporting an aircraft from the EU

Jun 2023 - Updated 2024 FI

No. 17 – What is the correct use of a corporate aircraft?

Mar 2023 - Updated 2024 FI

No. 16 – Which customs procedures can be used for parking an aircraft within the EU?

Jan 2023 - Updated 2024 TA FI

No. 15 – Liability and risk elements associated with EU importation and admission

Oct 2022 - Updated 2024 TA FI

No. 14 – Part 3: Using Temporary Admission – when does an operator need help?

Aug 2022 – Updated 2025 TA

No. 13 – Importation impacts when traveling the world in corporate aircraft

Jun 2022 - Updated 2024 FI

No. 12 – How to get the 0% airline VAT exemption meant for commercial operators

May 2022 - Updated 2024 FI

No. 11 – Part 2: Using Temporary Admission – what do customs look for during a ramp check, and why?

Mar 2022 – Updated 2025 TA

No. 10 – How to handle aircraft maintenance correct in a customs context

Feb 2022 - Updated 2024 TA FI

No. 9 – Part 1: Using Temporary Admission – the Supporting Document

Dec 2021 – Updated 2025 TA

No. 8 – Do not fall into the operator trap when flying within the EU and UK

Oct 2021 - Updated 2024 TA FI

No. 7 – Which offshore aircraft registrations can be used with Temporary Admissions when flying within the EU and UK?

Sep 2021 - Updated 2024 TA

No. 6 – Flying with EU-resident persons onboard when using Temporary Admission

Aug 2021 - Updated 2025 TA

No. 5 – What about private use of corporate aircraft?

May 2021 - Updated 2025 TA FI

No. 4 – What does ‘VAT paid’ mean?

Mar 2021 - Updated 2024 FI

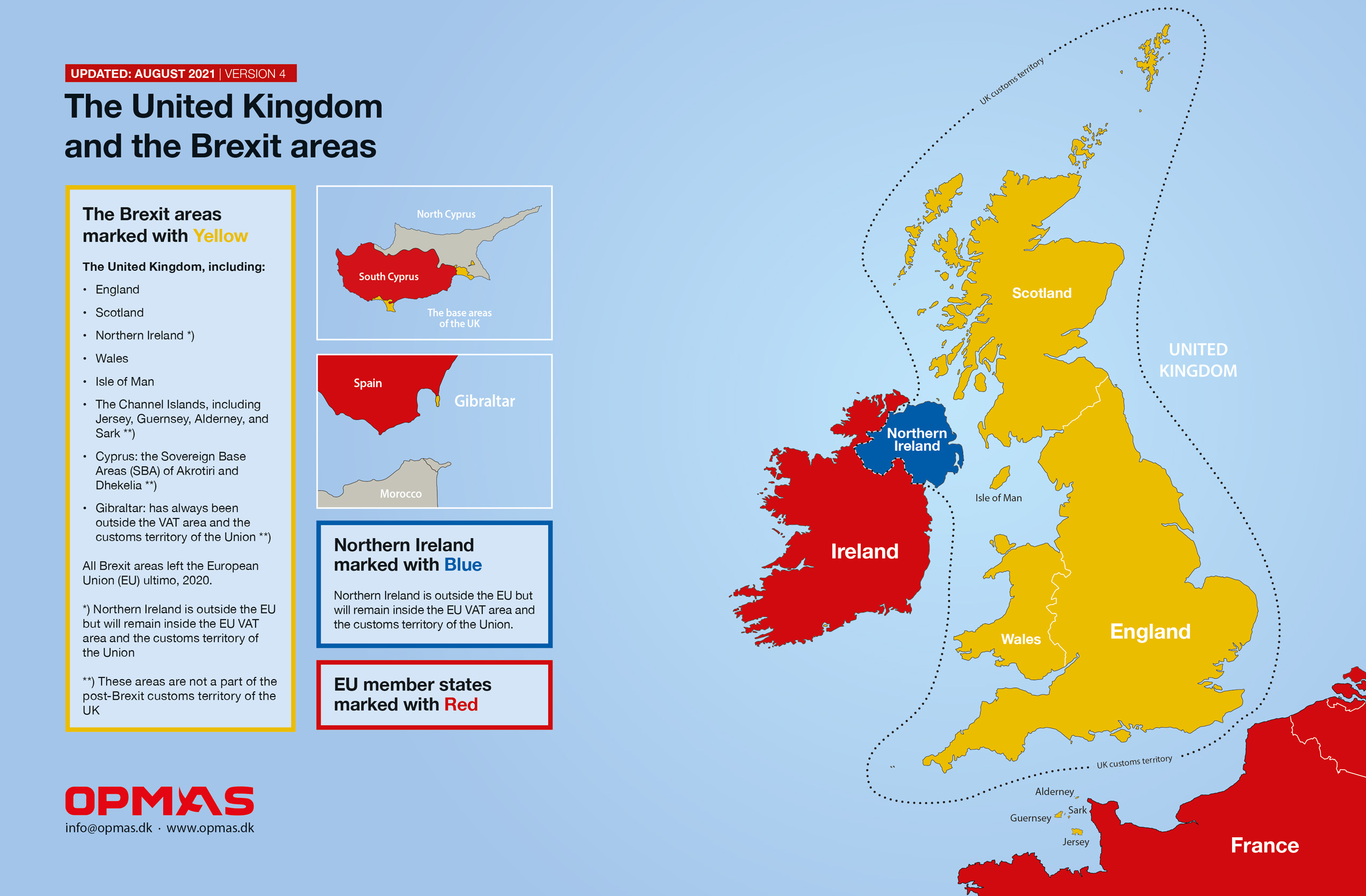

No. 3 – Is a full importation needed in both the UK and the EU27?

Mar 2021 - Updated 2024 FI

No. 2 – Flying commercially within the EU

Feb 2021 - Updated 2025 TA FI

No. 1 – Flying with the CEO

Nov 2020 - Updated 2025 TA FI