COMMERCIAL AND CORPORATE FLYING WITHIN THE EUROPEAN UNION

Short & Sweet no. 15

Liability and risk elements associated with EU importation and admission

Added 2022 – Updated January 2024

- Do you know the potential customs liability and related risks when flying within the EU?

- How does the chosen importation method influence the liability and risk elements?

- The dire consequences and risks, if not EU compliant, when flying outside the EU

Clients often ask about the difference in liability and risk when choosing between the two importation methods when wanting to fly within the EU. In this article, we dive a bit deeper into the topic.

The customs aspect of flying within the EU

The customs aspect of flying within the EU

Any aircraft flying into the EU will operate under customs control using either the Temporary Admission procedure (TA) or full importation (FI). There are no other options. The TA procedure can only be used by EU outsiders where the aircraft is owned (including any UBOs), operated, registered, and based outside the EU, leaving EU insiders only one option: full importation. EU outsiders can, of course, choose to use full importation instead of TA if they find it beneficial. However, both options can be used commercially or privately if applied correctly.

This means that EU outsiders can choose to use full importation instead of TA if they find it beneficial. Reasons to do so could be the establishment of an EU base for the aircraft or the wish for flexibility with free circulation within the EU.

The liability depends on how the aircraft is used

Both importation methods have their set of preconditions that must be met. The preconditions create liabilities if the aircraft is used wrongly according to EU regulations, so both procedures have limitations in the usage of the aircraft. All aircraft owners and operators wish to know these limitations prior to choosing an importation method so they can mitigate any liability and risk. In Figure 1, we have provided a simple overview of the key factors involved.

Figure 1: How does the liability affect the scope of use?

| Importation method used | Scope of liability | Scope of use |

|---|---|---|

| Temporary Admission | Liability is only temporary while flying within the EU | Wide* |

| Full Importation | Liability never stops, even though the aircraft is exiting the EU | Narrow** |

** If fully imported, an aircraft must be used solely for the correct economic activity, e.g., as a corporate or commercial aircraft, depending on the type of importation. This is based on the EU-defined set of preconditions for the VAT handling during an EU importation. Any private use of the aircraft will often create problems and situations which must be handled correctly. See Short & Sweet 6 and Short & Sweet 13.

The dire consequences and risks, if not EU compliant also when flying outside the EU

In a customs and VAT context, a full importation will entail that all worldwide trips must be conducted continuously according to EU regulations. This means that a non-business or corporate leg flown, e.g., in the US/Asia, where the compensation for private usage of the aircraft is not handled correctly according to EU rules, will have a negative impact on an EU VAT assessment during an eventual audit by the EU VAT authorities. Such a situation will, in many cases, trigger a payment to the authorities, as the import VAT will partly be seen as wrongly declared as business or corporate use. Here, non-compliance with the full importation procedure will most likely activate a direct payment of the VAT (17-27%) and customs duty (2.7%) based on the aircraft’s value.

It sounds absurd, but there is no way around it

We know that this consequence of a full EU importation might sound absurd for many EU outsiders, especially if they have opted for a full EU importation to have the EU free circulation status as a convenient thing, has a completely non-EU operating structure, and is domiciled, e.g., in the US. We have seen that many US operators have the full focus on staying compliant with FAA and IRS rules and might not consider other jurisdictions, which can pose unforeseen consequences for the operator and an unpleasant surprise and side-effect when choosing the full importation method. Therefore, we always recommend that EU outsiders use the TA procedure whenever possible, as these consequences only relate to the full importation method.

“Most EU outsiders do not need the free circulation status, so why take on vast and unnecessary risks and liabilities when flying to and within the EU if opting for full importation. The TA procedure will be the better option for most operators.”

Conclusion

EU insiders: Incorporate the limitations in your operational manual, as there are no other options.

EU outsiders: Most EU outsiders do not need the earlier mentioned free circulation status and should be ready to take on vast and perhaps unnecessary risks and liabilities when flying to the EU if opting for full importation. In addition, this also means that the operator should be ready to adapt to the risk situation and perhaps limit or completely stop any worldwide private use of the aircraft. If this is not possible or wished for, the TA procedure will be the better option.

IMPORTANT!

Various exotic papers scandals have shown that the risk of extensive audits is very costly. The Paradise Papers have shown that operators can be heavily hit if an aircraft with a full importation is not used correctly after the importation. We are here to advise and secure your position and setup, eliminating any doubt about right and wrong usage of an aircraft.

The Temporary Admission procedure has become a very well-defined customs procedure

Please note that TA can be used to fly privately, corporately, and commercially within the EU without any problems and with EU-resident persons onboard if applied correctly. Since 2014, the TA procedure has become a very well-defined customs procedure, especially for corporate and commercial aviation. This is thanks to the huge effort from, e.g., the EU Commission and NBAA.

Important things to know about Temporary Admission

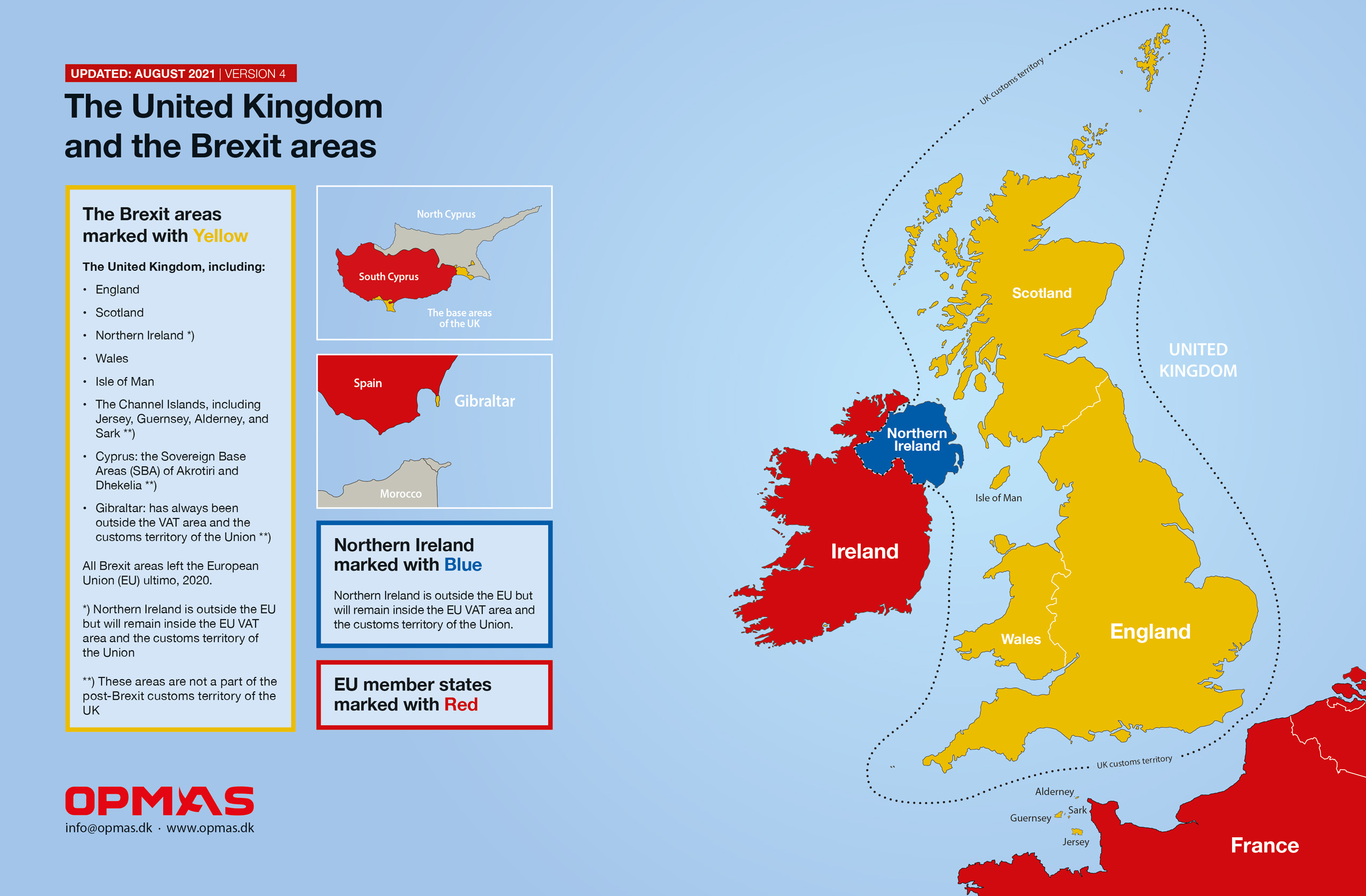

Operators should be aware that different interpretations of the TA procedure exist between member states. Thus, it is important to have a competent customs agency outline the correct use and understanding based on the specific setup. The problem with local interpretations is often related to flights within France, Spain, Portugal, Italy, Greece, and less often other places. Click here to see a list of the known grey zone areas where different interpretations of the TA procedure exist and where an operator often needs guidance to use TA safely. None of the grey zone areas create problems for using TA if correctly handled and documented.

Important things to know about full importation

Operators should be aware that full importation includes a potential VAT and tax liability, requires onwards continuous correct worldwide economic activity as well as correct handling of any potential worldwide non-business use and or non-commercial use; requirements that the TA procedure does not have. The statute of limitations is five years for full importation, and the use of the aircraft must worldwide stay fully compliant with current EU regulations until the end of this period.

How can we help?

If you have questions about the above, please do not hesitate to contact us.

List of all OPMAS

Short & Sweet mails:

No. 22 – What does it take to be compliant?

Jun 2024 TA FI

No. 21 – Part 4: Using Temporary Admission – how to prepare for a customs ramp check

Jan 2024 TA

No. 20 – Buying or selling aircraft within, to, or from the EU

Nov 2023 TA FI

No. 19 – The real differences between full importation and Temporary Admission

Sep 2023 - Updated 2024 TA FI

No. 18 – Exporting an aircraft from the EU

Jun 2023 - Updated 2024 FI

No. 17 – What is the correct use of a corporate aircraft?

Mar 2023 - Updated 2024 FI

No. 16 – Which customs procedures can be used for parking an aircraft within the EU?

Jan 2023 - Updated 2024 TA FI

No. 15 – Liability and risk elements associated with EU importation and admission

Oct 2022 - Updated 2024 TA FI

No. 14 – Part 3: Using Temporary Admission – when does an operator need help?

Aug 2022 – Updated 2024 TA

No. 13 – Importation impacts when traveling the world in corporate aircraft

Jun 2022 - Updated 2024 FI

No. 12 – How to get the 0% airline VAT exemption meant for commercial operators

May 2022 - Updated 2024 FI

No. 11 – Part 2: Using Temporary Admission

– what do customs look for during a ramp check, and why?

Mar 2022 – Updated 2024 TA

No. 10 – How to handle aircraft maintenance correct in a customs context

Feb 2022 - Updated 2024 TA FI

No. 9 – Part 1: Using Temporary Admission – the Supporting Document

Dec 2021 – Updated 2024 TA

No. 8 – Do not fall into the operator trap when flying within the EU and UK

Oct 2021 - Updated 2024 TA FI

No. 7 – Which offshore aircraft registrations can be used with Temporary Admissions when flying within the EU and UK?

Sep 2021 - Updated 2024 TA

No. 6 – Flying with EU-resident persons onboard when using Temporary Admission

Aug 2021 - Updated 2024 TA

No. 5 – What about private use

of corporate aircraft?

May 2021 - Updated 2024 TA FI

No. 4 – What does ‘VAT paid’ mean?

Mar 2021 - Updated 2024 FI

No. 3 – Is a full importation needed

in both the UK and the EU27?

Mar 2021 - Updated 2024 FI

No. 2 – Flying commercially

within the EU

Feb 2021 - Updated 2024 TA FI

No. 1 – Flying with the

CEO

Nov 2020 - Updated 2024 TA FI