LAST CALL: Grandfather your pre-Brexit UK C88 form to a EU27 importation form

- Important: To holders of a pre-Brexit UK or Isle of Man C88 importation form

- Act now, the time is running out

- Sometime in 2023 is the absolutely last chance to use the RGR process to re-import aircraft

- It does not matter where the aircraft stayed New Year’s Eve 2020 (31-DEC-2020)

This article only relates to a full importation into the EU. It does not apply to the use of the Temporary Admission procedure.

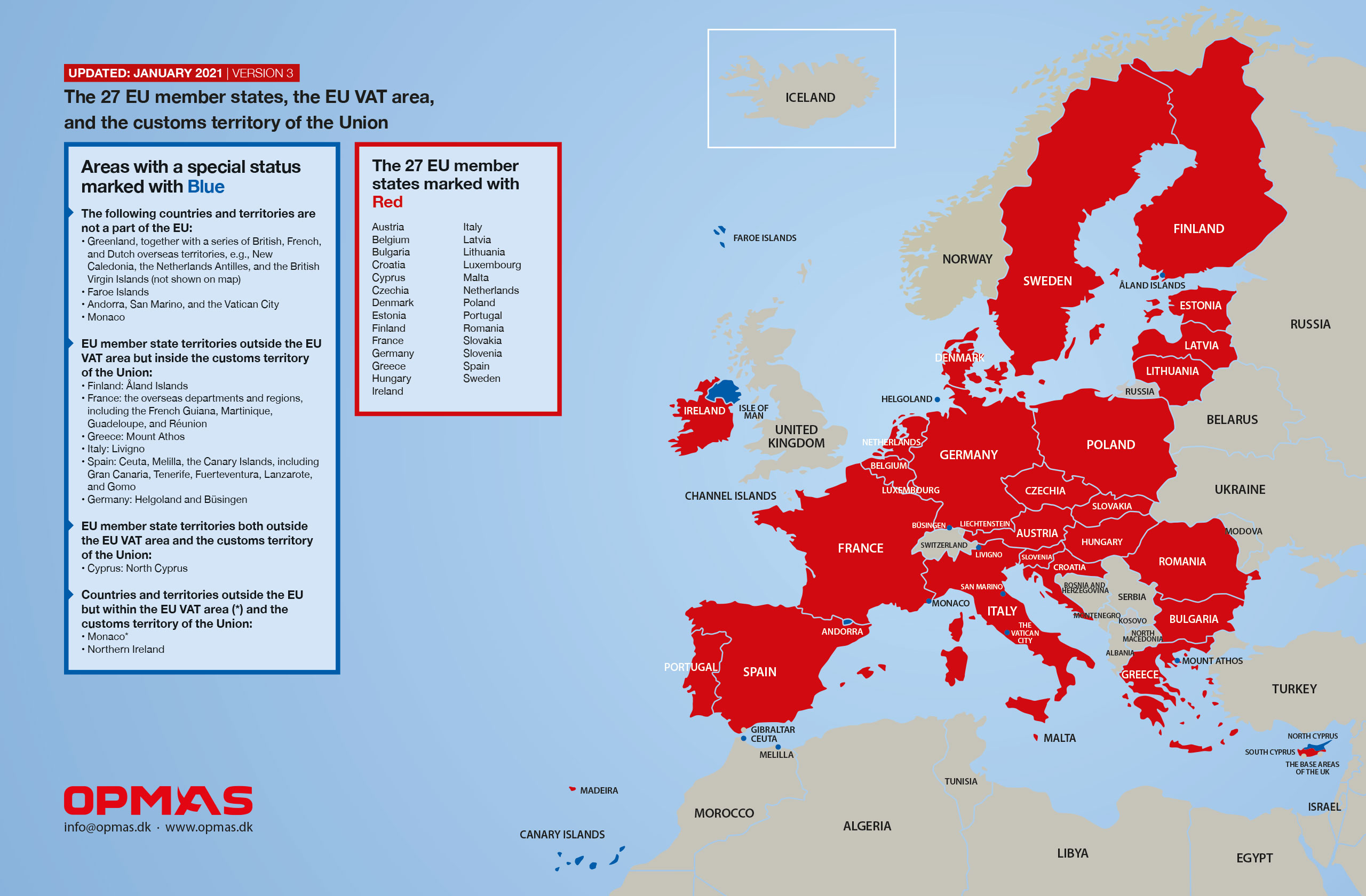

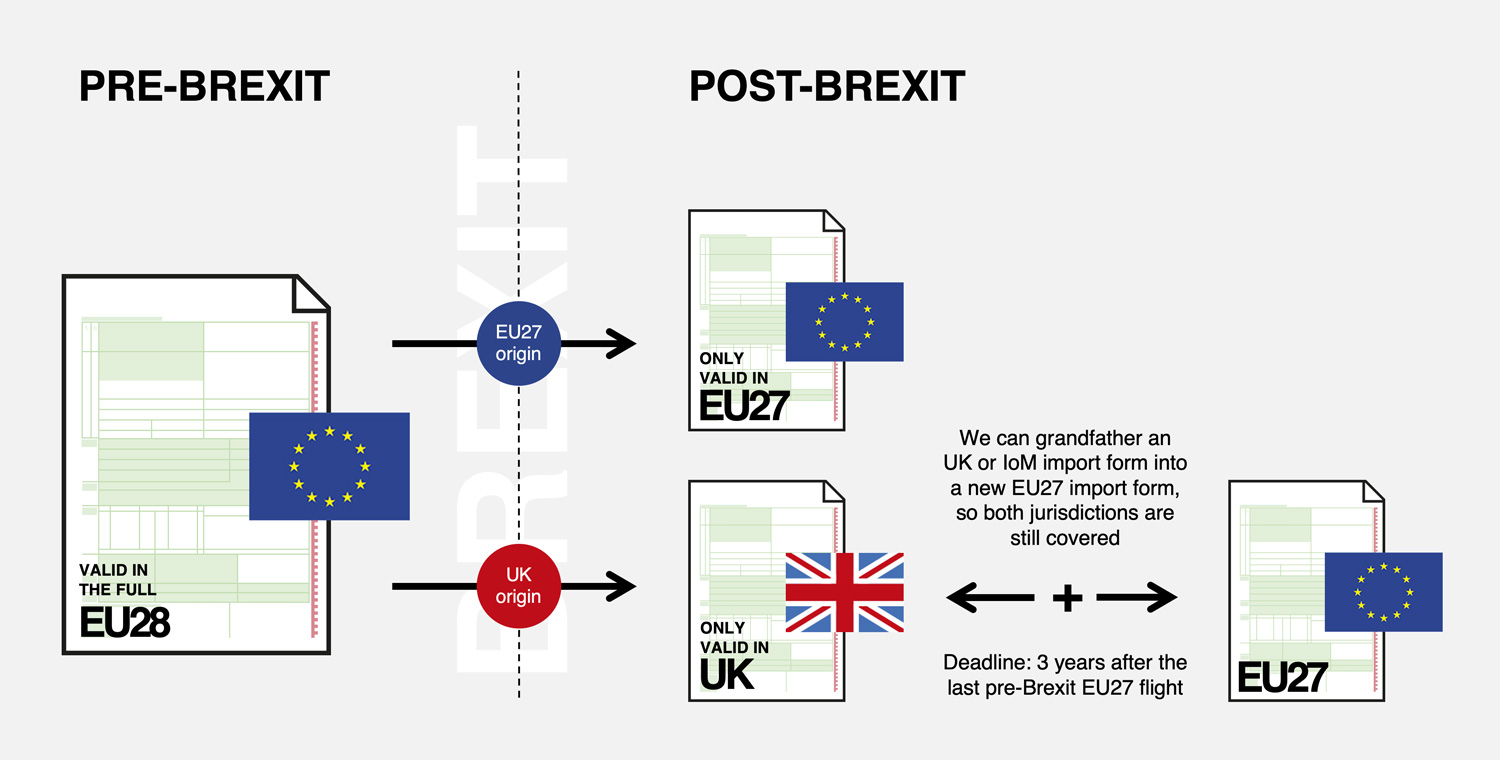

A pre-Brexit EU27 importation is only valid within the EU27, just as a pre-Brexit UK importation will only be valid within the UK. This is the consequence of Brexit, and no full importation will automatically be grandfathered into the opposite zone.

However, the rules of the Returned Goods Relief (RGR) might be a way to grandfather an aircraft importation into the opposite zone. The end result of such a re-importation process will generate a new importation form in the opposite zone without payment of the customs duty and the Value Added Tax (VAT). Grandfathering an importation into the opposite zone will result in the aircraft being imported into both zones; hence the original importation will not be altered. We have handled many of these cases and now have a streamlined process.

The great advantage of the Returned Goods Relief (RGR)

The use of the RGR comes with no preconditions attached to the use of the aircraft, whereas a normal full importation will require 100% correct business or commercial use of the aircraft. This is a vast advantage when using the RGR.

IMPORTANT! Act now, the time is running out The holders must initiate the RGR process themselves and finalize the process within three years of the aircraft’s last flight in the EU27 prior to Brexit (31-DEC-2020). For example, if the last flight in the EU27 took place on May 26th, 2020, then the ultimate deadline to handle the physical re-importation in Denmark is May 26th, 2023. The verification and approval process must be expected to take between 3-6 weeks, so it is important to start the paperwork ASAP. Again, it does not matter where the aircraft stayed New Year’s Eve (31-DEC-2020).

What are the preconditions?

The five points below must be fulfilled.

- A valid importation document. A valid, fully readable importation form must be presented, joint by documentation for the VAT handling relating to the importation and an eventual subsequent sale of the aircraft.

- The re-importing entity must be the same as the exporter. This means that the aircraft must be re-imported by the same entity that exported the aircraft from the EU the last time. If the aircraft has been sold since the importation, please contact us for a verification of the possibilities.

- The 3-year-rule.The aircraft will only qualify if it has not left the customs territory of the Union for a continuous period exceeding three years since the importation. This can, in most cases, be proven by a logbook and other relevant documents.

- The aircraft must be in the same condition.The aircraft must be in the same state as originally imported. However, any treatment or handling outside the customs territory of the Union is not an issue, including preservation of the aircraft’s appearance, restoration, or maintenance to keep the aircraft in good condition, or any necessary repairs.

- Physical presence of the aircraft is needed. The aircraft must be present for the physical re-importation after all of the documentation has been approved.

Figure explaining the validly of a full importation, performed before Brexit

Selected links covering this issue

HMRC (UK) Guidance – Pay less import duty and VAT when re-importing goods to the UK

Follow OPMAS on LinkedIn

Get a continuously stream of news and hints about EU importation and admission issues.

Remember to click Follow on LinkedIn