COMMERCIAL AND CORPORATE FLYING WITHIN THE EUROPEAN UNION

Flying to the UK post-Brexit

Updated November 2023

- The UK has left the EU back in 2020

- See how to fly to the UK post-Brexit

- This guidance is made for UK visitors

![]() The UK is a separate customs jurisdiction post-Brexit, just like Norway, Switzerland, Russia, the US, Canada, etc. Any UK outsider can fly into, e.g., London Biggin Hill and leave again without any restrictions by following the simple Temporary Admission (TA) rules for a customs entry. Internal UK flights can happen by complying with the same TA procedure and adhere to the same limitations and restrictions as earlier enforced within the EU28; when the EU included the UK. Please remember not to confuse this with immigration and passport issues.

The UK is a separate customs jurisdiction post-Brexit, just like Norway, Switzerland, Russia, the US, Canada, etc. Any UK outsider can fly into, e.g., London Biggin Hill and leave again without any restrictions by following the simple Temporary Admission (TA) rules for a customs entry. Internal UK flights can happen by complying with the same TA procedure and adhere to the same limitations and restrictions as earlier enforced within the EU28; when the EU included the UK. Please remember not to confuse this with immigration and passport issues.

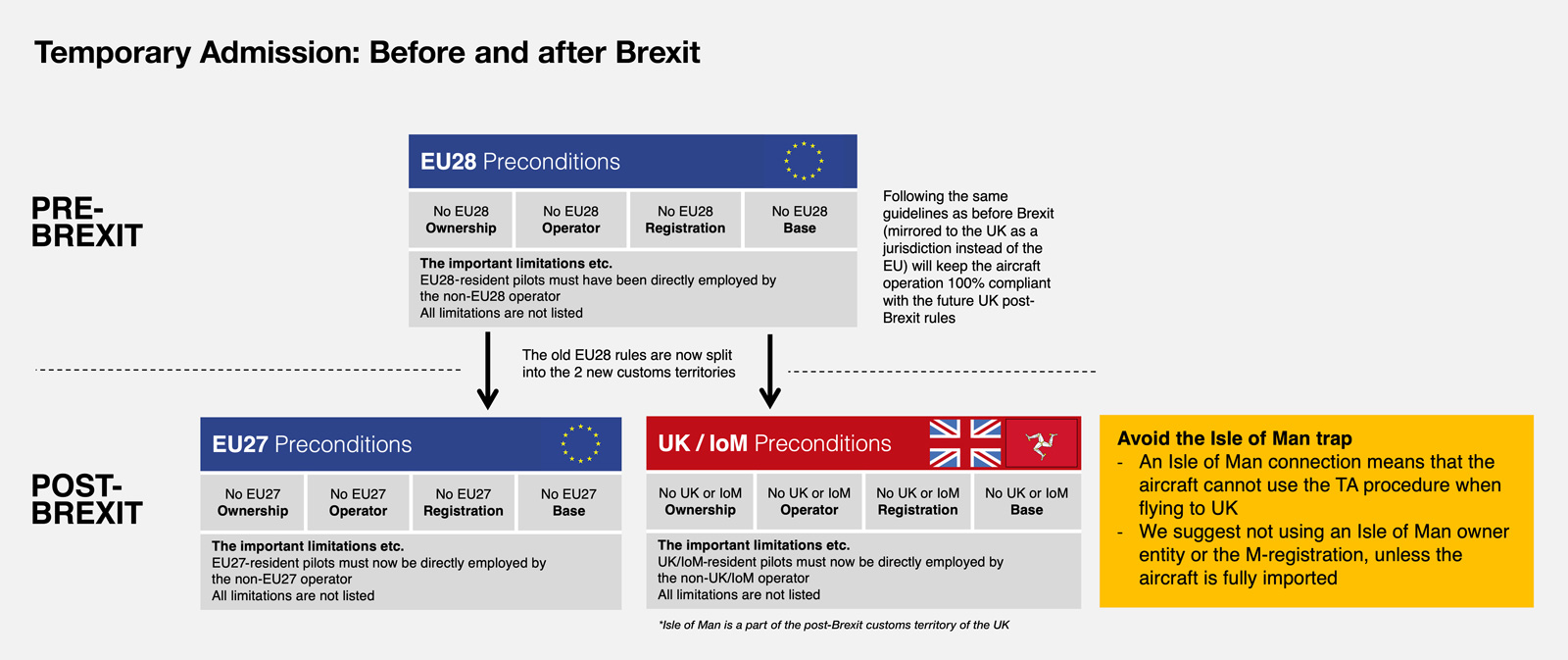

The EU has traditionally been more complicated than other jurisdictions due to the size of the area and the different opinions of the various member states. This is why an aircraft owner or operator will often want to have some kind of customs paperwork onboard (e.g., an EU full importation form or various documentation to prove TA compliance) whenoperating within the EU; in our opinion, this is not needed for the UK. The UK has, post-Brexit, fully adapted all aspects of the earlier EU28 TA procedure, allowing corporate flights and/or residents as passengers onboard internal flights. Consequently, there are no known grey zones when using the TA procedure on the British Isles. Nevertheless, following the same guidelines as before Brexit, mirrored to the UK as a jurisdiction instead of the EU, will keep the aircraft operation 100% compliant with the future UK post-Brexit rules. Please see the figure below for further explanation.

The TA procedure is meant to be paperless, and the use of the UK Supporting Document (SD) is not mandatory. The SD is only meant as a tool to document entries and exits, which can alternatively be handled easily by the flight logs; for further information, you can see the UK customs (HMRC) website where they state that the act of crossing the UK border counts as a customs declaration and the operator does not need to fill out any forms, including the SD.

When is a full importation needed in the UK?

A full importation into the UK will only be needed if the aircraft will be based, registered (G or M), or spends the majority of its time within the UK/IoM or is owned (including any UBOs), operated, or registered by a UK/IoM entity. The UK customs territory also includes the Isle of Man, which is the reason for the Isle of Man being mentioned in this context.

We often hear the following questions from operators: “We have earlier chosen to fully import our aircraft into the EU – will we now have to fully import the same aircraft into the UK?” and “Shall we fully import a potential new aircraft into both the EU27 and the UK?”. The latter is often referred to as “dual importation”.

There is no logic behind fully importing an aircraft into every new economic zone or country that the aircraft will fly to. A full importation should only be performed within the EU27 or the UK if you absolutely have to, as you commit to only use the aircraft for correct economic activity for the next many years while operating the aircraft. Please imagine the scenario when trying to comply with two or three different and conflicting sets of regulations on how to handle non-business use correctly, which will be the situation if, for example, a US part 91 operator chooses to import into both the EU27 and the UK. The FAA and IRS rules are often conflicting with the EU27 and the UK rules on how to pay for non-business use and how much pay. For example, imputed income is commonly used by US operators but is not accepted within the EU27 and the UK as a compensation method. It is often simply impossible to comply correctly with the rules in all jurisdictions simultaneously. The EU27 and the UK rules are aligned as they have the same EU28 origin but will eventually differ over the years.

These aircraft registrations can be used within the UK for Temporary Admission

All aircraft registrations, except G (UK) and M (Isle of Man).

Temporary Admission is easy within the UK

The use of the Supporting Document (SD) is, as mentioned above, not mandatory when arriving in the UK. Just remember that an operator must always be ready to document the following:

- the flight pattern within the UK (use the SD and flight logs or just flight logs)

- compliance with the TA procedure; all criteria are met with the correct handling of the limitations (not all limitations are mentioned in this guidance)

How can we help?

We are, of course, always ready to discuss and check specific UK flights for TA compliance and guide you. TA will probably be the best option for many UK visitors. If you have questions about the above, please do not hesitate to contact us.

Selected links covering this issue

Various documents and links from HM Revenue & Customs (UK)

UK Supporting Document for an oral customs declaration