COMMERCIAL AND CORPORATE FLYING WITHIN THE EUROPEAN UNION

Short & Sweet no. 7

Which offshore aircraft registrations can be used with Temporary Admissions when flying within the EU and UK?

- Chose the right registration to fly freely

- You might not want to use the Isle of Man (M) registration

- What are the pitfalls?

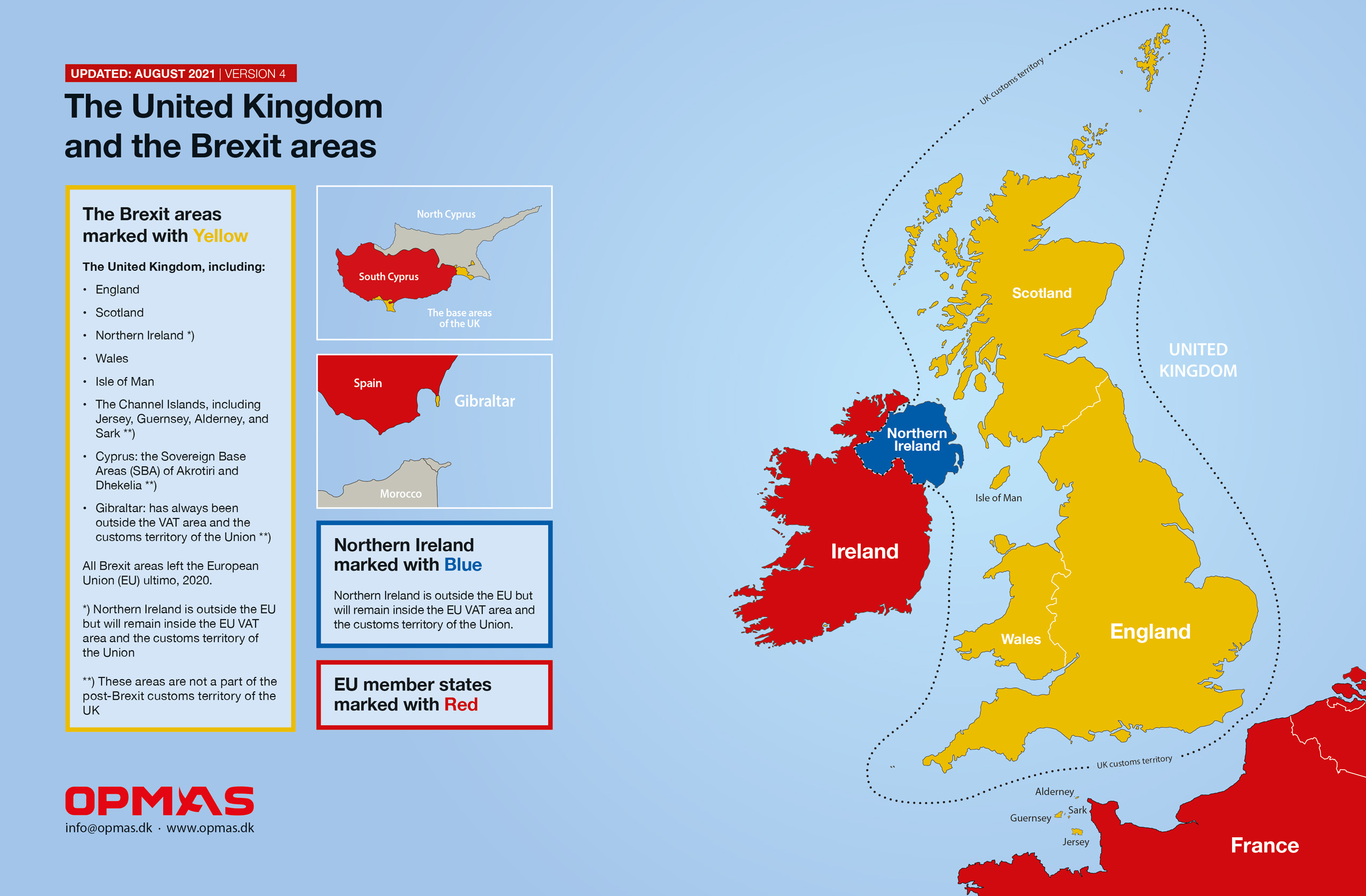

![]() We are often asked which offshore aircraft registrations can be used with TA when an aircraft is being used both within the EU and the UK by an owner (including the UBO) and/or by an operator which resides outside the EU or the UK.

We are often asked which offshore aircraft registrations can be used with TA when an aircraft is being used both within the EU and the UK by an owner (including the UBO) and/or by an operator which resides outside the EU or the UK.

The customs aspect of flying within the EU

Any aircraft flying into the EU will operate under customs control using either the Temporary Admission procedure (TA) or full importation (FI). There are no other options. The TA procedure can only be used by EU outsiders where the aircraft is owned (including any UBOs), operated, registered, and based outside the EU, leaving EU insiders only one option: full importation. EU outsiders can, of course, choose to use full importation instead of TA if they find it beneficial. However, both options can be used commercially or privately if applied correctly

Most aircraft registrations can be used without problems

Most of the popular offshore aircraft registrations can be used with a few exceptions. Please have a look at the table below. Note that an EU aircraft registration can never be used with TA when flying within the EU.

| Jurisdiction | ||

* Cyprus, Ireland, and Malta are all inside the customs territory of the Union (EU)

** The Channel Islands are all outside the customs territory of the UK

*** The Isle of Man is inside the customs territory of the UK

**** San Marino is outside the customs territory of the Union (EU)

You might not want to use the Isle of Man (M) registration

It is perfectly fine to use the M-registration or an Isle of Man owner entity (including the UBO) regarding the EU regulation and when flying within the EU if the total setup meets the requirements for the Temporary Admission procedure. However, the same setup may create vast problems if flying to the UK. As we anticipate most aircraft will eventually fly to the UK or that every owner wants to at least have the possibility, we suggest not using an Isle of Man owner entity or the M-registration.

An Isle of Man connection means that the aircraft cannot use the TA procedure when flying to the UK, leaving a full UK importation as the only option. In many ways, the HMRC (British customs) has limited the access to aircraft importations unless the imposed VAT (20% of the aircraft’s value) is fully paid without the possibility of reclaiming. The risk is that the aircraft will be impounded by the HMRC.

How can we help?

If you have questions about the above, please do not hesitate to contact us.

List of all OPMAS

Short & Sweet mails:

No. 24 – Can the Customs Warehouse procedure be used to close a deal?

Feb 2025 TA FI

No. 23 – Temporary Admission is supposed to be paperless, so why is documentation needed?

Oct 2024 TA

No. 22 – What does it take to be compliant?

Jun 2024 TA FI

No. 21 – Part 4: Using Temporary Admission – how to prepare for a customs ramp check

Jan 2024 – Updated 2025 TA

No. 20 – Buying or selling aircraft within, to, or from the EU

Nov 2023 TA FI

No. 19 – The real differences between full importation and Temporary Admission

Sep 2023 - Updated 2024 TA FI

No. 18 – Exporting an aircraft from the EU

Jun 2023 - Updated 2024 FI

No. 17 – What is the correct use of a corporate aircraft?

Mar 2023 - Updated 2024 FI

No. 16 – Which customs procedures can be used for parking an aircraft within the EU?

Jan 2023 - Updated 2024 TA FI

No. 15 – Liability and risk elements associated with EU importation and admission

Oct 2022 - Updated 2024 TA FI

No. 14 – Part 3: Using Temporary Admission – when does an operator need help?

Aug 2022 – Updated 2025 TA

No. 13 – Importation impacts when traveling the world in corporate aircraft

Jun 2022 - Updated 2024 FI

No. 12 – How to get the 0% airline VAT exemption meant for commercial operators

May 2022 - Updated 2024 FI

No. 11 – Part 2: Using Temporary Admission – what do customs look for during a ramp check, and why?

Mar 2022 – Updated 2025 TA

No. 10 – How to handle aircraft maintenance correct in a customs context

Feb 2022 - Updated 2024 TA FI

No. 9 – Part 1: Using Temporary Admission – the Supporting Document

Dec 2021 – Updated 2025 TA

No. 8 – Do not fall into the operator trap when flying within the EU and UK

Oct 2021 - Updated 2024 TA FI

No. 7 – Which offshore aircraft registrations can be used with Temporary Admissions when flying within the EU and UK?

Sep 2021 - Updated 2024 TA

No. 6 – Flying with EU-resident persons onboard when using Temporary Admission

Aug 2021 - Updated 2025 TA

No. 5 – What about private use of corporate aircraft?

May 2021 - Updated 2025 TA FI

No. 4 – What does ‘VAT paid’ mean?

Mar 2021 - Updated 2024 FI

No. 3 – Is a full importation needed in both the UK and the EU27?

Mar 2021 - Updated 2024 FI

No. 2 – Flying commercially within the EU

Feb 2021 - Updated 2025 TA FI

No. 1 – Flying with the CEO

Nov 2020 - Updated 2025 TA FI

OPMAS ApS

Soenderborggade 9

DK-8000 Aarhus C

Denmark

Tel: +45 70 20 00 51

Email: info@opmas.dk

Go to contact page

Follow Us on LinkedIn

Visit our LinkedIn page – get important news about EU importation and admission issues for aircraft owners and operators.

Design by www.himmelblaa.dk