COMMERCIAL AND CORPORATE FLYING WITHIN THE EUROPEAN UNION

Short & sweet no. 24

Can the Customs Warehouse procedure be used to close a deal?

- Is Customs Warehouse a safe haven for a deal?

- Can a Pre-Purchase Inspection be performed?

- What does the EU customs regulation allow?

We often hear that a Customs Warehouse (CW) provides aircraft brokers, owner, and operators a safe haven, suspending the payment of VAT and customs duty while doing a Pre-Purchase Inspection (PPI) or closing a deal, but what does the EU customs regulation actually allow?

Using a CW is based upon the idea of having a safe location with no VAT, tax, or other duties applicable. Like a free port as we would say in the old days, where no consequences exist as long the goods are in a bonded warehouse behind the fences of the free port.

Below are our comments based on a yearlong dialogue with various customs agencies, legal advisers, and our case experience from the past.

We find that two things matter: 1) the nature of the sale, and 2) how a Customs Warehouse service is defined.

1) The nature of sale

It is normally not allowed to sell goods while they are in a CW. However, the EU customs code states that digital distance sales to retailers are allowed to a limited extent. This means that it is not allowed to do an on-site sale or have the physical presence of the representatives of a seller or a purchaser.

A retail sale is defined as a sale of generic goods, e.g. 1,000 t-shirts sold by a manufacturer to a retailer. In this case, we are not talking about unique products like an aircraft identified with a serial number.

It is not possible to characterize the sale of an aircraft as anything but both a physical sale and a sale of specific goods. The sale is always about a specific aircraft and the aircraft will always undergo a physical check and on-site inspection by the purchaser or representatives. It must be mentioned that it has never established what the term “limited extent” exactly means or limits.

All these facts alone clearly indicate that using CW for closing a deal is not supported by the EU customs regulation.

2) Is “closing a deal” correct use of Customs Warehousing services?

The basic use of a CW must be storage of a product, which is not in use. An aircraft which is flying into a CW and departing again flying will be seen as “being in use”, as it is still airworthy, still registered while in storage, and still able to fly or taxi using own power. This is at least the common perception and the typical arguments amongst CW specialists.

All the above means that a sale in a CW will most likely be seen as a circumvention of full importation for free circulation. A CW can simply not be used as an alternative to free circulation or the use of Temporary Admission, as the sale of an aircraft is not seen as correct use of the Customs Warehouse service.

What about performing a PPI under CW without closing a deal?

The nature of the PPI will collide with the allowed basis use of CW services, as the aircraft will be flying in and out of the CW and must be considered as “being in use” as described above. This argument will also render a test flight impossible while under CW.

If customs are willing to disregard the “being in use” element, it is in fact allowed to perform some light technical services as long this part is limited to checking logbooks, visual checks, or relatively simple tests of the aircraft such as to check if the condition of the aircraft meets the agreed technical standards. No normal MRO work is allowed.

What is right and wrong?

We acknowledge that there are many opinions about this issue. Still, we are confident that the above explanation is correct. Unfortunately, there are no clear aviation-related ECJ judgement covering the topic, but there is no doubt that the use of CW for the mentioned purpose is very questionable and risky.

WARNING

If you are tempted to use the CW procedure for closing a deal or doing a PPI and believe that your local customs have a different practical interpretation of the procedure than described above, please ask the local customs for a binding assessment ruling, approving the correct purpose, before asking your local customs agent to initiate the procedure.

REMEMBER

The seller always bears the risk of handling (collecting) the EU VAT correctly when an aircraft is sold within the EU. A seller should at least know about and evaluate this risk before closing a sale in a CW.

How can we help?

If you have questions about the above, please do not hesitate to contact us.

List of all OPMAS

Short & Sweet mails:

No. 24 – Can the Customs Warehouse procedure be used to close a deal?

Feb 2025 TA FI

No. 23 – Temporary Admission is supposed to be paperless, so why is documentation needed?

Oct 2024 TA

No. 22 – What does it take to be compliant?

Jun 2024 TA FI

No. 21 – Part 4: Using Temporary Admission – how to prepare for a customs ramp check

Jan 2024 – Updated 2025 TA

No. 20 – Buying or selling aircraft within, to, or from the EU

Nov 2023 TA FI

No. 19 – The real differences between full importation and Temporary Admission

Sep 2023 - Updated 2024 TA FI

No. 18 – Exporting an aircraft from the EU

Jun 2023 - Updated 2024 FI

No. 17 – What is the correct use of a corporate aircraft?

Mar 2023 - Updated 2024 FI

No. 16 – Which customs procedures can be used for parking an aircraft within the EU?

Jan 2023 - Updated 2024 TA FI

No. 15 – Liability and risk elements associated with EU importation and admission

Oct 2022 - Updated 2024 TA FI

No. 14 – Part 3: Using Temporary Admission – when does an operator need help?

Aug 2022 – Updated 2025 TA

No. 13 – Importation impacts when traveling the world in corporate aircraft

Jun 2022 - Updated 2024 FI

No. 12 – How to get the 0% airline VAT exemption meant for commercial operators

May 2022 - Updated 2024 FI

No. 11 – Part 2: Using Temporary Admission – what do customs look for during a ramp check, and why?

Mar 2022 – Updated 2025 TA

No. 10 – How to handle aircraft maintenance correct in a customs context

Feb 2022 - Updated 2024 TA FI

No. 9 – Part 1: Using Temporary Admission – the Supporting Document

Dec 2021 – Updated 2025 TA

No. 8 – Do not fall into the operator trap when flying within the EU and UK

Oct 2021 - Updated 2024 TA FI

No. 7 – Which offshore aircraft registrations can be used with Temporary Admissions when flying within the EU and UK?

Sep 2021 - Updated 2024 TA

No. 6 – Flying with EU-resident persons onboard when using Temporary Admission

Aug 2021 - Updated 2025 TA

No. 5 – What about private use of corporate aircraft?

May 2021 - Updated 2025 TA FI

No. 4 – What does ‘VAT paid’ mean?

Mar 2021 - Updated 2024 FI

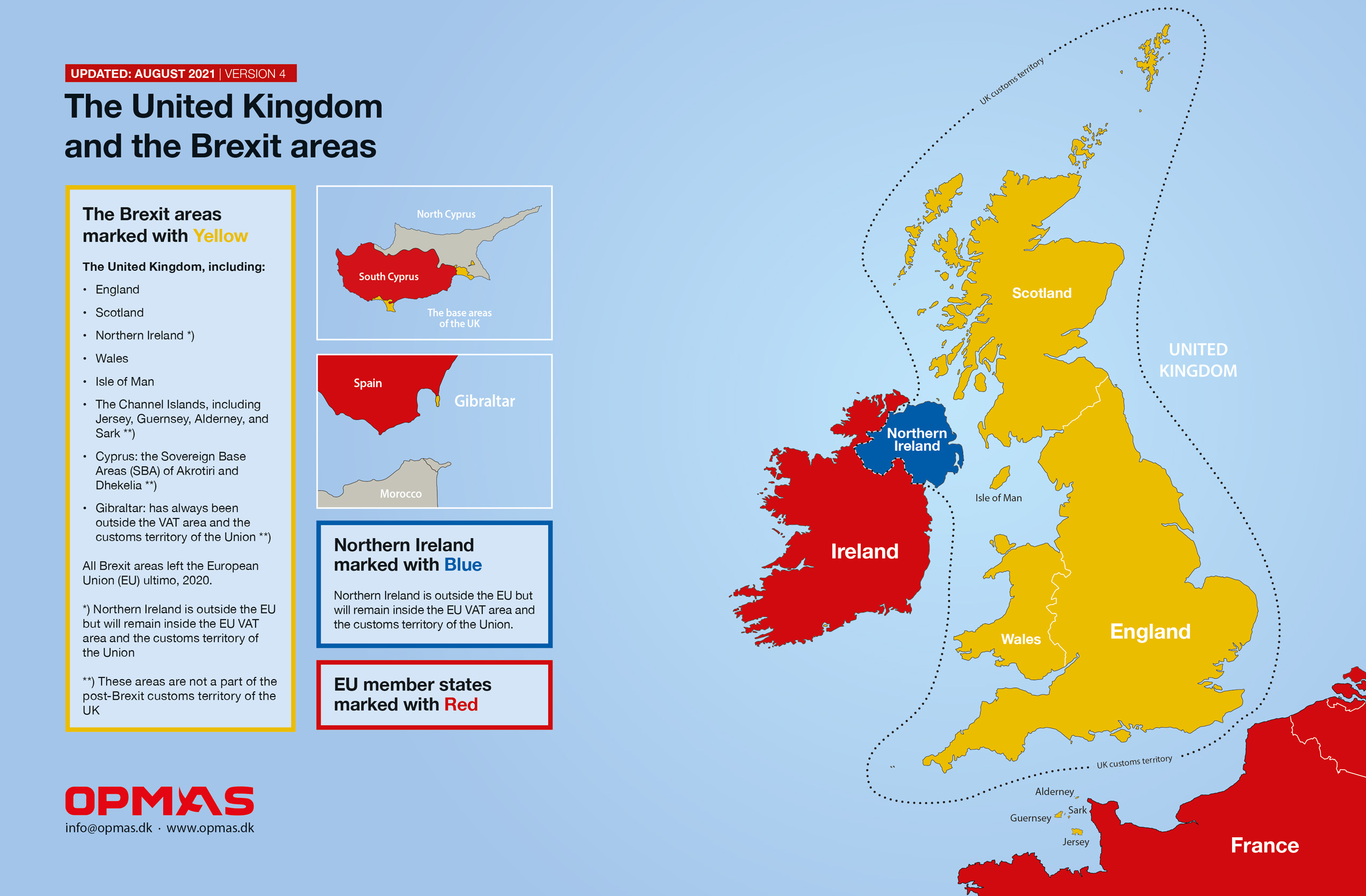

No. 3 – Is a full importation needed in both the UK and the EU27?

Mar 2021 - Updated 2024 FI

No. 2 – Flying commercially within the EU

Feb 2021 - Updated 2025 TA FI

No. 1 – Flying with the CEO

Nov 2020 - Updated 2025 TA FI