COMMERCIAL AND CORPORATE FLYING WITHIN THE EUROPEAN UNION

Short & Sweet no. 16

Which customs procedures can be used for parking an aircraft within the EU?

Added 2023 – Updated January 2024

Temporary Admission can normally be used for parking when visiting the EU

But can the Customs Warehouse Procedure also be used for parking or long-term storage?

Where are the grey zone areas and pitfalls?

We are often asked how to choose the correct customs procedure when an aircraft is going to be parked for a longer period within the EU. In this article, we dive a bit deeper into the topic and look at how the different customs procedures can be used in this respect.

![]() The customs aspect of flying within the EU

The customs aspect of flying within the EU

Any aircraft flying into the EU will operate under customs control using either the Temporary Admission procedure (TA) or full importation (FI). There are no other options. The TA procedure can only be used by EU outsiders where the aircraft is owned (including any UBOs), operated, registered, and based outside the EU, leaving EU insiders only one option: full importation. EU outsiders can, of course, choose to use full importation instead of TA if they find it beneficial. However, both options can be used commercially or privately if applied correctly.

Temporary Admission

The aircraft is allowed to stay or park for up to six months at a time when operated by EU outsiders visiting the EU. A new six-month period can be initiated upon a new entry into the EU. EU outsiders should never fear parking their aircraft during their visit to the EU, but continuously flying in and out of the EU with longer periods of stay at the same destination could eventually get the operator or aircraft considered as having established a local or fixed EU base – changing the status of the visiting EU outsider to become an EU insider. Please have a look at these fixed base indicators if relevant.

TA can, in general, only be used when the purpose of flights is transportation of persons. This is why TA cannot be used where the purpose of a flight is parking, storage, maintenance (MRO), etc. We have seen cases where normally Swiss-based aircraft for a longer period were flown empty to a rented (cheaper and available) hangar in France for parking between flights to and from Switzerland. These cases ended badly when French customs realized that the real purpose of the stay was parking or hangarage and not transportation of persons. These scenarios clearly required a full importation even though the same operator and aircraft were able to use TA correctly if they had flown to France with passengers onboard.

Full importation

The aircraft will be in free circulation within the EU and can be parked without any customs restrictions. EU outsiders should, however, always be aware of other consequences of using full importation before choosing this option over TA.

Customs Warehouse

The Customs Warehouse Procedure does not support any scenarios where the purpose is parking or long-term storage, nor can the procedure be used to facilitate any kind of maintenance (MRO) activities.

WARNING

If the procedure is used for parking or long-term storage, the usage might be considered circumventing the regulation, whereas a full importation should have been used instead. If you feel rightfully tempted to use the Customs Warehouse Procedure for parking or long-term storage and believe that your local customs have a different practical interpretation of the procedure than described above, please secure the case by asking the local customs for a binding assessment ruling, approving the correct purpose before asking your local customs agent to initiate the procedure.

Inward processing

The Inward Processing Procedure can only be used to facilitate aircraft maintenance (MRO) and does not support any scenarios where the purpose is parking or longtime storage. This procedure can only be used by EU outsiders.

Important things to know about Temporary Admission

Operators should be aware that different interpretations of the TA procedure exist between member states. Thus, it is important to have a competent customs agency outline the correct use and understanding based on the specific setup. The problem with local interpretations is often related to flights within France, Spain, Portugal, Italy, Greece, and less often other places. Click here to see a list of the known grey zone areas where different interpretations of the TA procedure exist and where an operator often needs guidance to use TA safely. None of the grey zone areas create problems for using TA if correctly handled and documented.

Important things to know about full importation

Operators should be aware that full importation includes a potential VAT and tax liability, requires onwards continuous correct worldwide economic activity as well as correct handling of any potential worldwide non-business use and or non-commercial use; requirements that the TA procedure does not have. The statute of limitations is five years for full importation, and the use of the aircraft must worldwide stay fully compliant with current EU regulations until the end of this period.

How can we help?

If you have questions about the above, please do not hesitate to contact us.

List of all OPMAS

Short & Sweet mails:

No. 24 – Can the Customs Warehouse procedure be used to close a deal?

Feb 2025 TA FI

No. 23 – Temporary Admission is supposed to be paperless, so why is documentation needed?

Oct 2024 TA

No. 22 – What does it take to be compliant?

Jun 2024 TA FI

No. 21 – Part 4: Using Temporary Admission – how to prepare for a customs ramp check

Jan 2024 – Updated 2025 TA

No. 20 – Buying or selling aircraft within, to, or from the EU

Nov 2023 TA FI

No. 19 – The real differences between full importation and Temporary Admission

Sep 2023 - Updated 2024 TA FI

No. 18 – Exporting an aircraft from the EU

Jun 2023 - Updated 2024 FI

No. 17 – What is the correct use of a corporate aircraft?

Mar 2023 - Updated 2024 FI

No. 16 – Which customs procedures can be used for parking an aircraft within the EU?

Jan 2023 - Updated 2024 TA FI

No. 15 – Liability and risk elements associated with EU importation and admission

Oct 2022 - Updated 2024 TA FI

No. 14 – Part 3: Using Temporary Admission – when does an operator need help?

Aug 2022 – Updated 2025 TA

No. 13 – Importation impacts when traveling the world in corporate aircraft

Jun 2022 - Updated 2024 FI

No. 12 – How to get the 0% airline VAT exemption meant for commercial operators

May 2022 - Updated 2024 FI

No. 11 – Part 2: Using Temporary Admission – what do customs look for during a ramp check, and why?

Mar 2022 – Updated 2025 TA

No. 10 – How to handle aircraft maintenance correct in a customs context

Feb 2022 - Updated 2024 TA FI

No. 9 – Part 1: Using Temporary Admission – the Supporting Document

Dec 2021 – Updated 2025 TA

No. 8 – Do not fall into the operator trap when flying within the EU and UK

Oct 2021 - Updated 2024 TA FI

No. 7 – Which offshore aircraft registrations can be used with Temporary Admissions when flying within the EU and UK?

Sep 2021 - Updated 2024 TA

No. 6 – Flying with EU-resident persons onboard when using Temporary Admission

Aug 2021 - Updated 2025 TA

No. 5 – What about private use of corporate aircraft?

May 2021 - Updated 2025 TA FI

No. 4 – What does ‘VAT paid’ mean?

Mar 2021 - Updated 2024 FI

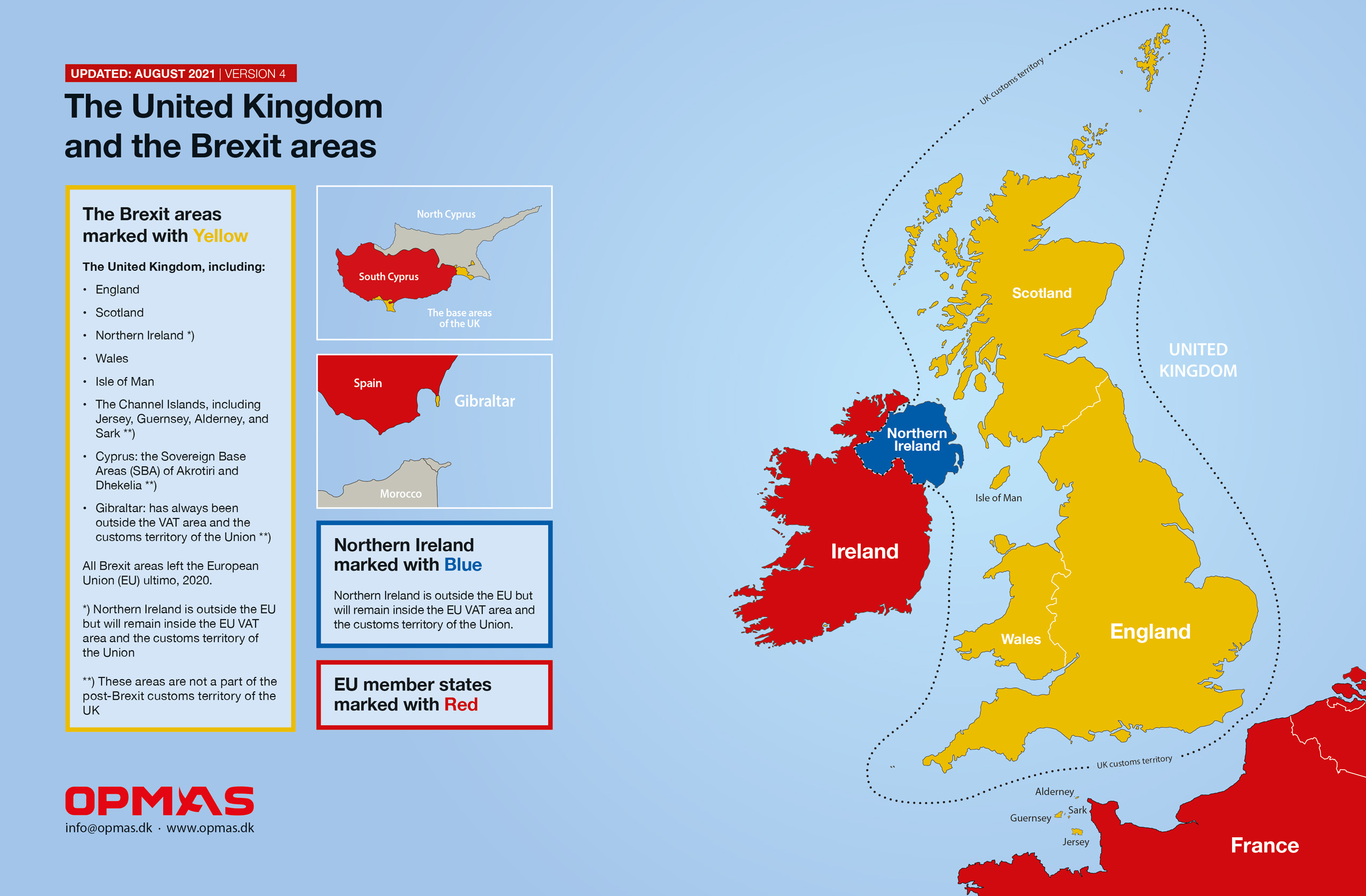

No. 3 – Is a full importation needed in both the UK and the EU27?

Mar 2021 - Updated 2024 FI

No. 2 – Flying commercially within the EU

Feb 2021 - Updated 2025 TA FI

No. 1 – Flying with the CEO

Nov 2020 - Updated 2025 TA FI