COMMERCIAL AND CORPORATE FLYING WITHIN THE EUROPEAN UNION

Short & Sweet no. 19

The real differences between full importation and Temporary Admission

-

Select the flight privileges needed

-

See the risks and liabilities involved

-

Get a basis for a decision on how to fly within the EU

-

Choose the most applicable customs procedure

We have made a simple overview of the main decision points when choosing between full importation and Temporary Admission (TA). The overview is made primarily for EU outsiders but will of course also grant EU insiders a view on the same issues.

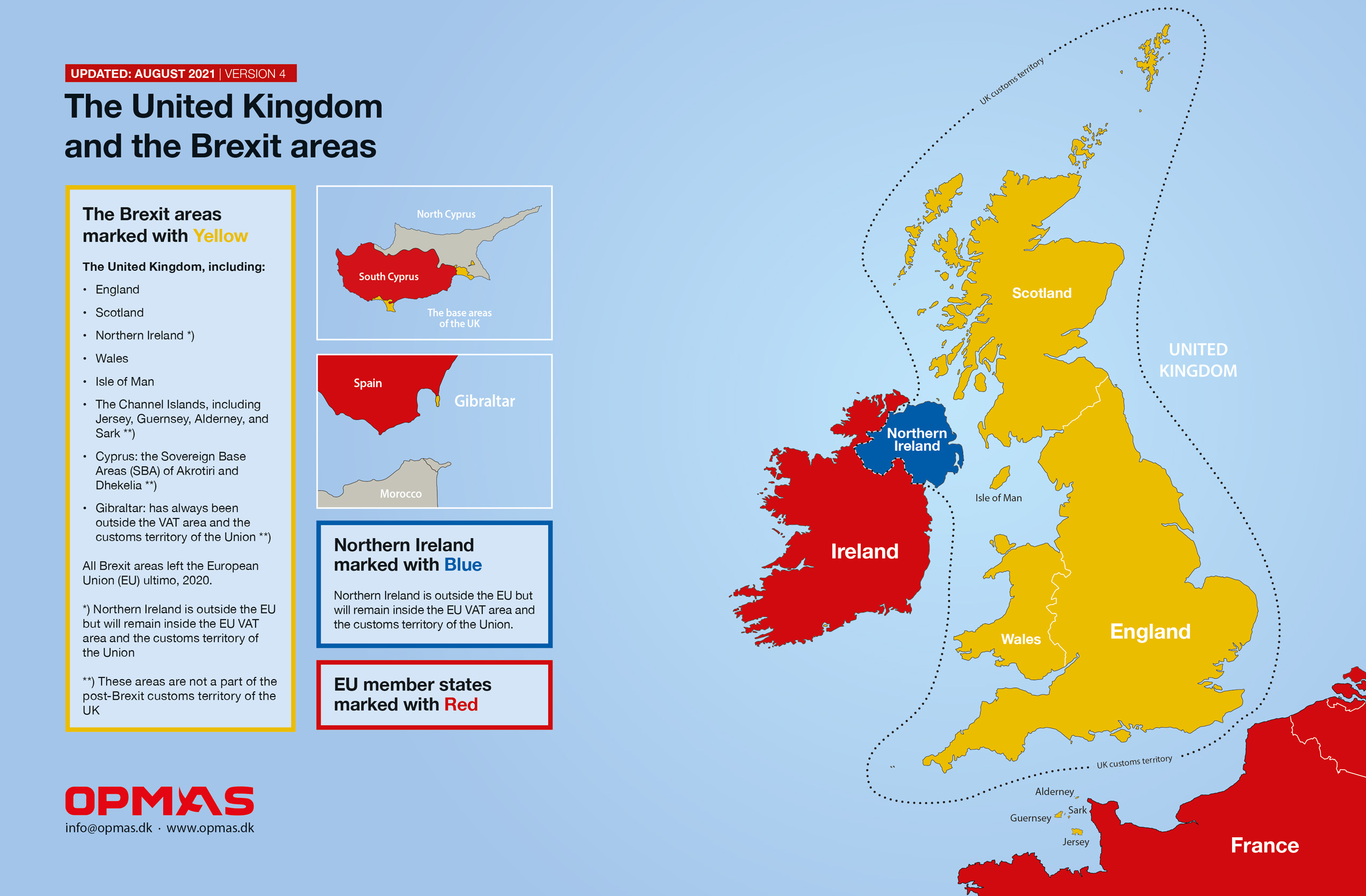

Any aircraft flying into the EU will operate under customs control using either the Temporary Admission procedure (TA) or full importation. There are no other options. If the aircraft is not already fully imported, the aircraft will automatically be considered as flying under the TA procedure even though the owner or operator has not themselves taken any action to activate this procedure or realized that their aircraft is flying under TA. The TA procedure is thus always required when flying to the EU, even for a flight with only one stop within the EU. Here, non-compliance with TA will most likely activate a direct payment of the VAT (ranging from 17-27%) and customs duty (2.7%) for the owner or operator. The TA procedure can only be used by EU outsiders where the aircraft is owned (including any UBOs), operated, registered, and based outside the EU, leaving EU insiders only one option: full importation. EU outsiders can, of course, choose to use full importation instead of TA if they find it beneficial. However, both options can be used commercially or privately if applied correctly.

Any aircraft flying into the EU will operate under customs control using either the Temporary Admission procedure (TA) or full importation. There are no other options. If the aircraft is not already fully imported, the aircraft will automatically be considered as flying under the TA procedure even though the owner or operator has not themselves taken any action to activate this procedure or realized that their aircraft is flying under TA. The TA procedure is thus always required when flying to the EU, even for a flight with only one stop within the EU. Here, non-compliance with TA will most likely activate a direct payment of the VAT (ranging from 17-27%) and customs duty (2.7%) for the owner or operator. The TA procedure can only be used by EU outsiders where the aircraft is owned (including any UBOs), operated, registered, and based outside the EU, leaving EU insiders only one option: full importation. EU outsiders can, of course, choose to use full importation instead of TA if they find it beneficial. However, both options can be used commercially or privately if applied correctly.

Please have a look at the below tables and start locating the flight privileges needed and then learn about the risks and liabilities involved and thereafter take a decision on how to fly within the EU using the most applicable customs procedure.

| Nature of the customs entry method | Full importation | Temporary Admission |

| How are taxes handled? | Payment of all taxes 1) | Suspension of all taxes |

| Scope of use | Mandatory for EU insiders, but a full importation can be chosen as the preferred option by EU outsiders if they want a free circulation status | Only possible for EU outsiders |

| Aircraft structure and registration | Full importation | Temporary Admission |

| Involvement of EU elements | Yes | No 3) |

| Flight pattern, period of stay, and base | Full importation | Temporary Admission |

| Flying to one EU destination | Yes | Yes |

| Flying internally within the EU | Yes | Yes |

| Maximum period of stay | Unlimited | Six months per stay 4) |

| Fixed established EU base | Yes | No 4) |

| Persons onboard allowed | Full importation | Temporary Admission |

| EU passengers on internal EU-flights | Yes | Yes 5) |

| EU crew on internal EU-flights | Yes | Yes 6) |

| Type of flights allowed within the EU | Full importation | Temporary Admission |

| Corporate flights | Yes | Yes |

| Private flights | Yes | Yes |

| Commercial flights, like Part 135 group charters | Yes | Yes |

| Allowed to fly commercially within EU member states without getting traffic rights (charter permits) | No | No |

Green = Possible Yellow = Impossible

If you want a deeper insight into the differences between full importation and Temporary Admission, please look at our Quick Guides and choose your preferred operator scenario.

International Charter Operators Private and Corporate Operators

If you want a deeper insight into the differences between full importation and Temporary Admission, please look at our Quick Guides and choose your preferred operator scenario.

| Risks and liabilities | Full importation | Temporary Admission |

| The biggest risks | Wrong and unaccepted use 2) of the aircraft, e.g., non-business use of a corporate aircraft or non-commercial use of a commercial aircraft | Ramp checks without the operator being ready and able to prove the TA compliance convincingly |

| Geographical areas that the aircraft must be used correctly according to the EU regulation | Worldwide. After the importation, any future use of the aircraft, no matter where the aircraft is flying, must conform to the EU regulations | Only when flying within the EU |

| Statute of limitation | The VAT liability exists five years after the physical importation | Only when flying within the EU |

| Is non-business use allowed inside and outside the EU for corporate aircraft (Part 91)? | The answer is no unless all non-business flights worldwide are compensated correctly according to the EU regulation | Yes, all kinds of use are allowed. No compensation are required at all |

| Is non-commercial use allowed inside and outside the EU if the aircraft was imported using the EU 0% airline exemption (Part 135)? | Generally, no. However, it depends on the exact preconditions in the EU member state where the aircraft was imported. The required minimum commercial use is different between EU member states | Yes, all kinds of use are allowed. No compensation are required at all |

Green = High flexibility Red = Low flexibility and extra liabilities

Legal background for Temporary Admission

The Istanbul convention from 1990, regulating the worldwide usage of TA, is not very precise, and the EU Commission has been and is continuously publishing various working papers and guidelines to clarify the correct understanding of TA and its usage in the EU. The 2014 working paper from the Union Customs Code Committee (available in English, French, and German) is especially important. Operators should always be aware that these documents are not binding for EU member states, which is why different interpretations exist between member states, thus also why it is important to have a competent customs agency outlining the correct use and understanding based on the specific setup. The problem with local interpretations is often related to flights within France, Spain, Portugal, Italy, and Greece.

Click here to see a list of the known grey zone areas where different interpretations of the TA procedure exist and where operators often need guidance to use TA safely. None of the grey zone areas create problems against using TA if correctly handled and documented.

How can we help?

If you have questions about the above, please do not hesitate to contact us.

- Taxes (the VAT) are typically deducted or exempted on the basis that correct use of the aircraft will happen

- Some business activities are not subject to VAT, such as selected real estate activities, banking and finance, insurance, gaming, and holding companies, etc. The listing is not complete. These activities will, therefore, not be seen as correct economic activities in this context

- San Marino (T7), Guernsey (2), and UK (G) registrations are compatible with TA

- The aircraft can stay up to six months per stay, and multiple entries are allowed

- This reply is based on solid EU working papers, but these papers are non-binding for EU member states. The topic can, therefore, be seen as a grey zone area. That is why we mention this reservation and recommend that all operators have proper documentation ready to present during a customs ramp check to secure flights with EU passengers

- There are no restrictions if EU-resident crew are employed by the declarant.

List of all OPMAS

Short & Sweet mails:

No. 23 – Temporary Admission is supposed to be paperless, so why is documentation needed?

Oct 2024 TA

No. 22 – What does it take to be compliant?

Jun 2024 TA FI

No. 21 – Part 4: Using Temporary Admission – how to prepare for a customs ramp check

Jan 2024 TA

No. 20 – Buying or selling aircraft within, to, or from the EU

Nov 2023 TA FI

No. 19 – The real differences between full importation and Temporary Admission

Sep 2023 - Updated 2024 TA FI

No. 18 – Exporting an aircraft from the EU

Jun 2023 - Updated 2024 FI

No. 17 – What is the correct use of a corporate aircraft?

Mar 2023 - Updated 2024 FI

No. 16 – Which customs procedures can be used for parking an aircraft within the EU?

Jan 2023 - Updated 2024 TA FI

No. 15 – Liability and risk elements associated with EU importation and admission

Oct 2022 - Updated 2024 TA FI

No. 14 – Part 3: Using Temporary Admission – when does an operator need help?

Aug 2022 – Updated 2024 TA

No. 13 – Importation impacts when traveling the world in corporate aircraft

Jun 2022 - Updated 2024 FI

No. 12 – How to get the 0% airline VAT exemption meant for commercial operators

May 2022 - Updated 2024 FI

No. 11 – Part 2: Using Temporary Admission

– what do customs look for during a ramp check, and why?

Mar 2022 – Updated 2024 TA

No. 10 – How to handle aircraft maintenance correct in a customs context

Feb 2022 - Updated 2024 TA FI

No. 9 – Part 1: Using Temporary Admission – the Supporting Document

Dec 2021 – Updated 2024 TA

No. 8 – Do not fall into the operator trap when flying within the EU and UK

Oct 2021 - Updated 2024 TA FI

No. 7 – Which offshore aircraft registrations can be used with Temporary Admissions when flying within the EU and UK?

Sep 2021 - Updated 2024 TA

No. 6 – Flying with EU-resident persons onboard when using Temporary Admission

Aug 2021 - Updated 2024 TA

No. 5 – What about private use

of corporate aircraft?

May 2021 - Updated 2024 TA FI

No. 4 – What does ‘VAT paid’ mean?

Mar 2021 - Updated 2024 FI

No. 3 – Is a full importation needed

in both the UK and the EU27?

Mar 2021 - Updated 2024 FI

No. 2 – Flying commercially

within the EU

Feb 2021 - Updated 2024 TA FI

No. 1 – Flying with the

CEO

Nov 2020 - Updated 2024 TA FI